“EVERYONE’S ENTITLED TO THEIR OWN OPINION, BUT NOT THEIR OWN FACTS” —Daniel Patrick Moynihan

Brooks Institute continues to be an issue

Ventura’s City Council’s bad deal with Brooks Institute exposes its lack of financial understanding. The Council

Brooks Institute closure exemplifies Ventura’s bad financial management.

and the city staff are scrambling to cover up those flaws. They’re feeding voters information designed to distract the public from the real issues. Ventura city staff believes it did enough due diligence. They’re trying to sell that opinion as fact in a Ventura Breeze article dated Sept. 13, 2016. The city staff’s facts ignore economic reality, though. Follow the money and you will always find the truth. Brooks Institute is no exception.

Everyone’s entitled to their own opinion, but not their own facts

Venturans for Responsible and Efficient Government (VREG) followed the money trail. VREG filed a Freedom of Information Act request with the city. The city provided the documents they evaluated to extend Brooks Institute a 46-month lease. What VREG learned reveals incompetence and lack of understanding.

W Brooks Institute is not an isolated problem; it’s a symptom of a larger problem. It shows the city council’s inability to manage taxpayer money. Brooks Institute surfaced at a time when the city is asking for another $270 million in taxes from Measure O.

Discovering The Cracks in the Foundation of the City’s Due Diligence

Brooks Institute exposed the cracks in the city’s procedures.

The city provided four foundational documents used to check Brooks Institute Holdings, LLC. The city staff believes these documents showed Brooks Institute was a good “risk.” In the private sector, these documents would have been insufficient. Here is why.

1) GP Homestay’s Commitment Letter Is Meaningless from a Financial Perspective

GP Homestay, Brooks Institute’s parent company, provided Ventura a ‘letter of guarantee.’ City Manager Mark Watkins announced this at the September 12, 2016 City Council meeting. The decision makers considered this meaningful in the decision to lease to Brooks. The letter has many shortcomings, though.

First, GP Homestay wrote the letter to a third party,not to the City of Ventura or any entity related to the Brooks Institute lease. GP Homestay wrote it to the WASC Senior College and University Commission on January 15, 2016. WASC Senior College and University Commission is an accreditation organization for Brooks Institute’s curriculum.

Second, nobody signed the letter. It is of no value to the City of Ventura as a basis for financial support, or to any of the other groups or businesses defrauded by Brooks.

Brooks Institute parent company, GPHomestay, took advantage of Ventura and its contractors.

Third, the contents of the letter are not something the city can depend on. The letter states, “Green Planet guarantees continued financial support for the proposed period of financial losses prior to reaching the break-even balance between revenues and expenses in 2020.”

This suggests two important facts. One, GP Homestay didn’t expect Brooks Institute Holdings, LLC to be profitable during the entire term of the lease. Two, after 2020, Green Planet could withdraw any financial support. These are hardly the assurances on which to base a 46-month lease, nor do they guarantee any payment.

2) Brooks Institute’s Loan Agreement with GP Homestay Arrives after the Fact

The city provided a loan agreement for $2.5 million dated March 28, 2016 between GP Homestay and Brooks Institute Holdings, LLC. This document is worthless from a financial perspective for several reasons.

First, the loan agreement is actually for a line of credit. There is nothing that indicates that the line of credit was ever signed or if Brooks Institute drew from it.

Second, nobody from GP Homestay signed the line of credit document. An unsigned document is worthless. It is unenforceable and not the basis for granting a 46-month lease.

Third, and most important, the date on the document is 33 days after the start of the signed lease. It could not have been available for the City Council to review while doing their due diligence.

The city approved the lease on February 22, 2016—more than a month before this document. So this document could not have factored into the decision to lease to Brooks Institute.

3) Dissecting Green Planet, Inc.’s Consolidated Opening Statement Balance Sheet

Green Planet, Inc. provided a consolidated statement to the city to support a 46-month lease. The statement dates back to June 16, 2015, making it eight months old at the time the city issued the lease.

Green Planet, Inc. consolidated statement includes six other corporations. To understand Brooks Institute Holdings, LLC, the city would have to separate out each of these corporations. That’s impossible with this statement. So, depending on this document for financial information would have been a waste of time. To cap it off, Green Planet, Inc. did not provide any guarantees to the city of the Lease Agreement or the construction period. This document doesn’t support the decision to lease space to Brooks Institute Holdings, LLC.

4) Brooks Institute Holdings, LLC Financial Documents Don’t Paint a Pretty Picture

The financial statements Brooks Institute Holdings, LLC provided lacked substance. First, the statements covered four months. Brooks Institute Holdings, LLC only existed since March 2, 2015.

Upon examining the financial statements, several irregularities signaled danger and demanded further questions. For instance, Brooks Institute Holdings, LLC’s available cash. Brooks would have had only $403,805 in cash if it paid all current liabilities. The balance sheet showed a cash balance of $2,750,598 and Current Liabilities of $2,346,793.

This statement was seven months old when the City Council discussed the lease agreement. Yet the city didn’t verify Brooks Institute’s available cash by demanding bank statements. The city had no way to know how much cash Brooks had available.

The Statement of Income showed a Net Operating Loss of $21,531. GP Homestay expected this loss and future losses until the year 2020, as they stated in their letter. Yet, the Statement of Income is misleading. The Statement of Income shows Net Income of $1,738,026. This is the result of the acquisition of the school valued at $1,759,557. The only reason it showed a Net Income was due to the value it placed on acquiring itself. An acquisition is a one-time, extraordinary event. It does not show true profitability.

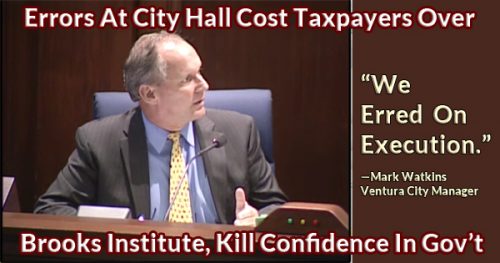

The Scramble to Cover Up the Flaws

The city began spinning the story soon after Brooks Institute closed its doors. First, there was City Manager Mark Watkins’ public mea culpa in the Ventura County Star. In it, he stated the city erred on execution on Brooks Institute by not collecting rents and fees. Next, there was an article in the Ventura Breeze by “City Staff” (whoever that is). It read, “As part of the City’s due diligence in determining the viability of the lease, the City was provided access to Brooks’ and its parent company’s (GPHomestay) confidential financial information. Based on that review it was determined that Brooks was solvent.” City Staff hoped nobody would discover the truth by examining the financial statements. Finally, there is Councilmember Cheryl Heitmann’s plea. She urged the city to get out in front of the problem at the September 12, 2016 council. She reckoned citizens were forming their own opinions without the city’s input.

The city’s rush to move Brooks Institute downtown forced city staff to cut corners.

The truth will out. The city was eager to do the lease with Brooks Institute. The city did a minimal review to rush the deal. After the fact, the City Manager admitted errors in the process. He stopped short of saying the city approved the lease without proper supporting documents. And the city failed to ask and answer many questions before it signed the lease. Even a cursory examination revealed Brooks had only $403,805 in cash. Brooks lacked enough funds to remodel the City site, let alone several other locations.

This situation will take years to resolve. Here’s what we do know now. Brooks Institute closed. The city has unpaid rents. Brooks stiffed contractors for tenant improvements they completed. The city will have to renovate the buildings Brooks leased to lease them to someone else. Brooks Institute Holdings, LLC didn’t couldn’t fulfill its obligations on the 46-month lease agreement. And, neither the city staff or the City Council researched enough before issuing a long-term lease agreement.

These are the facts. The city is trying to distract the public by zeroing in on the amount of money the city lost. The City Council and the City Manager want voters to believe the losses were $70,000. That amount of money is significant in itself. It may not be the full extent of the city’s exposure to losses, though. The real exposure is closer to $1,095,000. There is the $70,000 in lost rents from Brooks Institute. There is also the $825,000 mechanic’s lien by the contractors that the city refuses to pay. There will likely be legal costs to defend that position. Finally, it will cost $200,000 to return the sites into leasable condition according to Mark Watkins.

Editor’s Comments

The city played fast and loose with taxpayer money on the Brooks Institute deal. The city made several public apologies. They sympathized with the Brooks Institute students and facility over their loss. Yet, they admitted no wrongdoing. There was no apology to the City Council for making them look foolish and uninformed. But, worst of all, the city didn’t apologize to the taxpayers. It’s the taxpayers who pay for the city’s mistakes.

With or without an apology, though, one thing remains clear. The city has mismanaged taxpayer money on Brooks Institute. The situation demonstrates city staff and City Council’s incompetence or lack of understanding. So, it would be imprudent or foolhardy to trust this City Council with another $270 million through Measure O. Don’t give city government more money until they show they can spend the money they have. Vote No on O.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

You Have Reasons To Be Concerned How Ventura Spends Your Tax Money

/in Newsletters/by VREG Editors“Few things are harder to put up with than the annoyance of a good example”—Mark Twain

Complaining about how Ventura spends our tax money is like complaining about the weather. Everyone talks about it, but nobody does anything about it.

When Ventura spends money on projects, you trust and hope city officials would spend it as though it was coming out of their own pockets. However, many believe that City officials view tax revenue as an endless faucet spewing out money.

So, we rely on our elected officials to oversee the expenditures and question them when necessary. The following example illustrates how dysfunctional the oversight has become.

There Is No One Paying Attention To The Details

The City of Ventura Finance Committee considered a “small-dollar” expenditure at a recent meeting. Councilmember Christy Weir chairs the committee. Councilmember Cheryl Heitmann is the committee’s vice-chair. Deputy Mayor Neal Andrews also serves. Their job is to provide oversight to the city’s Director of Finance, Gil Garcia, and his staff in the Finance Department. Here is where the dysfunction begins.

The Finance Department wanted to spend $29,600 per year on outsourcing the opening of payment envelopes and processing of water bills. This dollar amount fell within Mr. Garcia’s spending authority and did not need the three City Councilmembers’ approval. He presented the item for discussion nonetheless.

Currently, Ventura Water sends water bills every two months and when payment is made city personnel open the envelopes and process the payments through the bank. The City now wants to send out water bills monthly. Since Ventura will change to monthly billing, the outsourcing costs would double to $59,200.

The city’s finance staff justified outsourcing this service to purportedly to improve cash flow and increase efficiency. The staff did not discuss or offer any evidence on just how they would be more efficient if their proposal were adopted.

Where’s The Oversight?

Only two City Councilmembers attended the committee meeting. Councilwoman Heitmann was absent. Neither Councilwoman Weir nor Councilman Andrews asked how much Ventura would save in real dollars by paying an outside company to perform this task, or how the city would adjust or reduce staffing after the change. The presenters assumed that handling thousands of checks and running them through the city’s bank account apparently would save money and reduce staff time.

A citizen attending the meeting spoke up and asked how much money we would save and how many staff people would be reduced or redeployed. The initial reply was the cost savings would be “minuscule.” When pressed to define what she meant by minuscule, the staff member was unprepared to provide any numbers. When pressed about changes in staffing, the answer was “none.”

Worrisome Questions Arise

That should cause every tax payer in this city to express concerns about the issues surrounding this spending proposal and by extension any plans to spend tax money regardless of the amount:

After all, with authority comes responsibility. It is not a blind trust. Maybe Ventura needs to review the policy for decisions made within a manager’s authority. All such decisions must be reviewed and supported by documentation.

You may be asking, “Why so focused on one instance such as this?” After all, it’s a small expense. It’s only $29,600 today. But soon, it’s going to double to $59,200. We must remind ourselves of Benjamin Franklin’s admonition — “Watch the pennies, and the dollars will take care of themselves.”

In this case $29,600 doubles within the year. No City Councilmember noted or questioned the expense. Why? Is it that our elected City Council members have become complacent? They trust staff recommendations unquestionably? They view this as so trivial it is not worth their time or effort? Or, are they no longer concerned about how they spend our tax dollars?

Editors’ Comment

When the costs in pennies turn to dollars then turn to thousands then turn to millions, and they run short again, who do YOU think they will look to for more money?

Concerned By This? Write A Councilmember.

Click on the photo of a Councilmember to send him or her a direct email.

Erik Nasarenko,

Mayor

Neal Andrews,

Deputy Mayor

Cheryl Heitmann

Matt LaVere

Jim Monahan

Mike Tracy

Christy Weir

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Politicians Expect You To Pay A Little Bit More

/in General News/by VREG EditorsThe Ventura County Star reports on Ventura’s Pension situation and mentions VREG.

The Ventura County Star Mentions VREG

We’re proud the Ventura County Star mentioned us in an article on pensions. The Star article lists VREG as a watchdog group.

Click here to go to the article.

We believe pensions and unfunded liabilities are ticking time bombs for the city. The Star joins us in pointing this out to Ventura citizens.

In Ventura’s budget starting July 1, the city will pay CalPERS almost $11 million. That’s the amount Ventura owes in unfunded liability. CalPERS projects that to at least double five years later, to over $22 million. That doesn’t include normal, ongoing costs.

That increase almost equals the revenue the half-cent sales tax will generate. The City Council supported the tax to pay for needs other than pensions. Taxpayers believed it was for infrastructure, public safety, homeless services, water quality and other priorities.

Taxpayer and watchdog groups accuse city leaders of misleading the voters. They knew Ventura needed the revenue to offset growing retirement costs.

The Star writes, “Venturans for Responsible and Efficient Government has made similar claims.”

How Bad The Situation Is Depends On Who You Talk To

City Finance Director, Gilbert Garcia, disagrees. He says the city will separate new sales tax revenue from the General Fund. It will be overseen by a soon-to-be-created citizen oversight board.

The state will pay money from Measure O to Ventura beginning in April. The oversight committee is not formed yet. That means no citizens won’t know if the money is separate until months after the fact. The city has had since November 9, 2016 to organize the citizens’ oversight committee. Yet, four months later citizens don’t have any safeguards in place.

The article notes. “How dire the situation is—or isn’t—depends on who you talk to.” How true.

The Ventura County Star reports on the burden city employee pensions are placing on City Hall.

If you ask a public employee they think the whole thing is way overblown and there is no problem. The public employee does not care that they impose a real burden on their neighbors. They have theirs. They worked for those benefits. The taxpayers owe them.

The Council members give the public employees what they want. They give little regard to the economic consequences on the rest of the citizens. It’s the hard working men and women who they will always expect to “pay a little bit more.”

IF THIS UPSETS YOU, WRITE YOUR COUNCILMEMBER

Click on the photo of a Councilmember to send him or her a direct email.

Erik Nasarenko,

Mayor

Neal Andrews,

Deputy Mayor

Cheryl Heitmann

Matt LaVere

Jim Monahan

Mike Tracy

Christy Weir

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Unaddressed Issues That Threaten Ventura’s Quality Of Life

/in Newsletters/by VREG EditorsThree unaddressed issues will be difficult to overcome.

VREG’s STATE OF THE CITY

[THE UNADDRESSED ISSUES MAYOR NASARENKO NEGLECTED TO DISCUSS]

No doubt that Ventura is a magnificent place to call home. On many aspects, VREG agrees on more points with our Mayor and City Council, than disagree. Ventura’s citizens are proud of our fine police force and our fire department. Our city employees are a dedicated group of men and women, who work hard and serve the community well.

THREE UNADDRESSED ISSUES

Some issues Mayor Nasarenko highlighted in his State-of-the-City speech are ones VREG has written about for years. Ventura has several issues that need attention before they grow out of control.

Mayor Nasarenko identified water and pensions among those issues in the State-of-the-City. The impending Brooks Institute lawsuit was conveniently overlooked. The mayor was short on details on how to solve them.

WATER: UNADDRESSED ISSUE #1

Water has been an unaddressed issue for over 37 years.

For 150 years, Ventura has failed to find an alternative source for water. In fact, with the loss of the Ventura River water wells, there are fewer resources. In 1972, Ventura opted to import 10,000 acre feet of water from the north. Ventura has paid and continues to pay for that every year without any pipeline with which to receive it. In 1989, the community faced a drought, and 52% elected to pursue desalinization. 48% chose to build a pipeline as an alternative. For the last 26 years, nothing has happened.

Now, with another 7-year drought which may be ending, a recent editorial in the Ventura County Star on the water crisis states:

In January, the Ventura City Council authorized a $430,976 study (or as low as $297,176 depending upon the results of the engineering study) to research the cost to connect to the State Water Project. The State Water Project that has existed for 46 years. Yet, Ventura cannot use it without extra infrastructure.

CITY COUNCIL NOT CONSIDERING ALL AVAILABLE OPTIONS

Our Mayor has also shared that Ventura is looking at potential sites for a water reuse plant. Dubbed the Ventura Water Pure, the plant is an advanced treatment facility. It will take 8 years to build the treatment facility. Projected costs range between $120 million and $142 million.

Water from this treatment facility could cost less than state water and would be more reliable. It is also about half the cost of energy-intensive desalinated water. From the start, such a plant could yield about one fourth of the city’s current annual water demand. According to our Mayor, the plant could later expand to meet future supply needs of Ventura.

One advantage of connecting to the State Water Project is that it will not take 8 years like the Ventura Water Pure plant will require.

Is there another water rate increase in the offering?

PENSIONS: UNADDRESSED ISSUE #2

Pensions are an unaddressed issue Ventura struggles with.

CalPERS annual billing for pensions is rising faster than employee contributions. As a result, the city continues to lose ground on employee pensions. The city’s annual cost of $16 million is projected to be $25 million by 2023. Ventura’s CalPERS payments are rising at over $1 million per year. Because CalPERS lowered its rate of return to 7% from 7.5%, add another $750,000 to the $1 million annually.

While our Mayor acknowledges the problem, he offers no solutions.

BROOKS INSTITUTE LAWSUIT: UNADDRESSED ISSUE #3

In August 2016, VREG concluded a lawsuit over Brooks Institute was inevitable. The lawsuit will come at taxpayer expense. The City Council and the City Manager downplayed the possibility at the time. This may have been an attempt to deflect the seriousness of the problem.

Fast forward to Feb. 8, 2017, one week before the Mayor’s State of the City. Ventura is now suing Brooks.

Editors’ Comments:

City government tries its best to serve our citizens. Like any community, there are also areas that either need improvement or simply require attention before big troubles get out of control. This is a collective reminder that we, as a community, through our elected officials, still have work to do in vital areas in order to sustain our way of life.

THINK VENTURA SHOULD TACKLE AT LEAST ONE UNADDRESSED ISSUE?

[WRITE YOUR COUNCILMEMBER]

Click on the photo of a Councilmember to send him or her a direct email.

Erik Nasarenko,

Mayor

Neal Andrews,

Deputy Mayor

Cheryl Heitmann

Matt LaVere

Jim Monahan

Mike Tracy

Christy Weir

Editors:

R. Alviani K. Corse T. Cook B. Frank

J. Tingstrom R. McCord S. Doll C. Kistner

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

How To Contact Your 2017 Ventura City Councilmembers

/in General News/by VREG EditorsTo make democracy work, we must be a nation of participants, not simply observers.

—Louis L’Amour

Our federalist system gives us many opportunities to participate in our democracy. Some forms of participation are more common than others. And some citizens participate more than others, but almost everyone has a voice in government.

Meet Your 2017 City Councilmembers

We have a new Ventura City Council for 2017. We have one new Councilmember and six incumbents. Each of them has an email account with the city. Not everyone knows how to contact them, though.

Click On A Councilmembers Photo To Email

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

Let then know what you’re thinking. Tell them what they’re doing right and what they could improve upon. No matter what you write, however, share your opinion. Not participating in government makes us worse because our city government isn’t working for all of us.

Erik Nasarenko,

Mayor

Neal Andrews,

Deputy Mayor

Cheryl Heitmann

Matt LaVere

Jim Monahan

Mike Tracy

Christy Weir

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

The Looming Catastrophe of Unfunded Pension Liabilities in Ventura

/in Newsletters/by VREG Editors“IT ISN’T WHAT WE DON’T KNOW THAT GIVES US TROUBLE, IT’S WHAT WE KNOW THAT AIN’T SO”

—Will Rodgers

NEGLECTING THE UNFUNDED PENSION CRISIS DOESN’T MAKE IT DISAPPEAR

For eight years Ventura has done little to remedy the unfunded pension liability. During that time, there have been three different City Councils. Yet they made only a modest effort to solve the problem. They got employees to agree to contribute toward their own retirement. Meanwhile, those same City Councils have exacerbated the problem. They granted large raises to public safety and SEIU employees. This is a case of ‘too little, too late’.

Eight years ago, we pointed out the amount of pension benefits Ventura owed. We owe these benefits to retired city employees and those about to retire. We owed $150,000,000 of unfunded liability. Two major pension plans account for the entire liability—Public Safety and Miscellaneous. The Public Safety pension plan covers police and fire retirees. The Miscellaneous pension plan covers all other employees.

The Ventura County Star reported the deplorable condition of Ventura’s pension plans. And, the Grand Jury labeled the plans as “out of control.”

The office of the City Manager tells us that they have everything under control. And, in 5 years things will level out. There are no records or calculations offered to support that statement.

STILL LIVING FAR BEYOND OUR MEANS

CalPERS sticks Ventura with rising unfunded pension liability costs.

The problem is simple. Ventura has not set aside enough money to pay for future benefits to city employees when they retire. What’s more, the California Pension System (CalPERS) let Ventura down. It did not earn enough return on investment on the money Ventura paid into the fund.

Since 2008, the situation has gotten far worse. In the last CalPERS report published in 2016, the city’s unfunded liability totaled $169,292,212. In other words, the liability we owe grew 12.9% in eight years.

ONE CITIZEN’S ANALYSIS

The City Manager and City Council knew of this UAL increase before they campaigned for Measure O.

Proceeds from Measure O will be more than $11 million a year for the next 25 years. It may not be enough to cover the debt, though.

CalPERS recently published the projected pension costs for the City of Ventura. Taxpayers are 100 percent responsible for paying these foreseeable costs.

The CalPERS Circular Letter Dated January 19, 2017 contained these facts:

CalPERS lowers its rate of return on investments to 7% impacting Ventura’s unfunded pension liabilities.

The CalPERS Board of Administration approved lowering the CalPERS discount rate on December 21, 2016.

The long-term rate of return will now be 7.00 percent over the next three years. This will increase public agency employer contribution costs beginning in Fiscal Year 2018-19.

For the years 2017 to 2023, CalPERS actuary reports show increases to the annual Unamortized Actuarial Liability (UAL). These costs will increase 91 percent or $8.8 million.

In the CalPERS Circular Letter dated 1/19/17, the assumed return rate decreased to 7 percent from 7.5 percent. Ventura will pay an extra $3.7 million from FY 2016-17 to FY 2022-23.

Combined, the city’s annual UAL cost will increase $12.5 million to $22.2 million over the next six years.

No other expense or revenue (tax) item will increase that fast. Left unaddressed, these increased costs may force the city to curtail basic services.

EDITORS’ COMMENTS:

Increasing revenue or reducing expenses solves most budget problems. For Ventura, increasing revenue means more sales taxes and property taxes. And reducing expenses means service cut backs or layoffs.

Increasing revenues and cutting expenses seems like the obvious fix. Yet, a less popular third option is available. The employees must contribute more toward their own retirement. After all, they will benefit the most from these pensions.

Ventura’s long-term solution will be a combination of all three choices. Increasing revenues and reducing expenses with higher employee contributions is the right prescription.

FEEL STRONGLY ABOUT THIS? WRITE YOUR COUNCILMEMBER.

Click on the photo of a Councilmember to send him or her a direct email.

Erik Nasarenko,

Mayor

Neal Andrews,

Deputy Mayor

Cheryl Heitmann

Matt LaVere

Jim Monahan

Mike Tracy

Christy Weir

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

New Year, New Look In 2017. Same Keen Insights.

/in General News/by VREG EditorsWe’ve updated our look for the New Year. We changed our logo and our website to begin 2017. The new look better reflects our mission and purpose.

Our New Logo Is Part Of Our New Look

The New Look Includes A Revamped Website

We’ve streamlined our website. You now have greater access to our investigative reporting on the city’s finances. The look is simpler and easier to navigate than our old site. Our most recent stories appear on the Home Page so you’ll always know what were currently working on. We’ve also enhanced the stories with graphics.

Our streamlined Home Pages gives you greater access to our investigative reporting on the city’s finances.

Our new front page features a spot for visitors to sign up for our newsletter. Please encourage your friends and like-minded acquaintances to subscribe.

Tell Us What You Think

Please share your feedback with us on our new logo and website. We welcome the opportunity to make our information more accessible to you.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Is Ventura Poised To Commit Another Real Estate Blunder With The Trade Desk?

/in Newsletters/by VREG Editors“ONLY THE MEDIOCRE ARE ALWAYS AT THEIR BEST”

—Jean Giroudoux

WILL VENTURA CITY GOVERNMENT EVER LEARN?

It’s déjâ vu all over again. Once again the past rears its ugly head. Only this time will the City Council be wise

Is The Trade Desk real estate deal a gift of taxpayer money to a private company?

enough to learn from its past mistakes? There are some things this Council and this city staff are not qualified to evaluate fully.

Among the first issues facing the 2017 Ventura City Council is a real estate transaction. Ventura is selling four parcels of City-owned, prime downtown public property. The properties for sale are at 535 East Main Street.

The fact that the City is pursuing the sale of surplus land is commendable. Selling these properties should be open and transparent. To do otherwise, invites the possible perception of favoritism or mismanagement of public funds. Proper evaluations, bidding and screening needs to happen.

CITY STAFF PROPOSES A NEW DEAL

Community Development Director, Jeff Lambert, presented a new real estate deal on November 15, 2016. He asked the City Council to approve the sale of a large, downtown city parking lot. The proposed buyer is a company called The Trade Desk. The Trade Desk wants to build a headquarters office building. The proposed offer was $1 million ($24 dollars a square foot).

City staff steered the selection of The Trade Desk as the sole qualified bidder. The City Council depended upon the recommendations of City Staff.

Four months earlier, the City Council relied on city staff’s recommendations on another deal. The city staff did an incomplete analysis before recommending the Brooks Institute project. They compounded this mistake by failing to collect deposits and rent. The Brooks Institute deal fell apart.

This time, the City Council was close to selecting The Trade Desk in another real estate deal. They almost decided without benefit of an independent financial analysis or a professional appraisal.

WHY THE TRADE DESK?

The Trade Desk is a Ventura success story. Does that entitle the company to favorable treatment from city government?

The Trade Desk is a success story many citizens do not know about. The City of Ventura funded an incubator business startup program. They used $5 million of taxpayer’s dollars to seed the fund. The Trade Desk was a beneficiary of the subsidized program. The Trade Desk is a large tech company that brought new jobs to Ventura. The company achieved early success. With their success, the Trade Desk went public and the stockholders have made millions. A true success story for Ventura.

The Trade Desk wants to enjoy the city’s largess, again. This time, they want to buy city property for their headquarters at below fair market value. Their business success should not cloud City Hall’s judgment. City Hall should not sell public property at a discounted price.

DOES THIS DEAL PASS THE SMELL TEST?

A first whiff of impropriety surfaced during the election. The Trade Desk donated $7,000 to support the successful city-backed ½¢ sales tax measure.

Another whiff arises with regards to the questions the city asked to approve The Trade Desk. A close examination of the specific judging criteria reveals the questions were subjective.

Of the three bids submitted, city staff selected The Trade Desk as the most qualified bidder. In its proposal, The Trade Desk offered $1,000,000 in cash for the properties.

The city purchased the properties for $618,000 in 1997. The city valued the properties at $1,684,000 in the original proposal. They base their estimate on a 6 year old value (10/25/10) comparable price for a city parking lot. The city’s valuation is $40 per square foot.

A QUESTION FROM THE AUDIENCE SLOWED DOWN THE PROCESS

The third impression of impropriety is how much the city valued the property. The city valued the property at $40 per square foot based on a 6-year old comparable property. In the same council meeting, city staff urged the Council to buy another parking lot for $64 per square foot. City staff recommended buying the parking lot for $64 per square foot. This established a new comparable price. The new comp values the parcels at 535 East Main Street at more than $1,684,000.

The City Council seemed oblivious to the conflicting valuations. A citizen in the audience brought it to the Council’s attention. Only then did the City Council call for an independent appraisal.

It’s a mistake to sell The Trade Desk these downtown lots for $1 million, when the true value is closer to $2 million.

GIFT OF PUBLIC FUNDS?

You decide if The Trade Desk real estate deal is in Ventura’s best interest.

The city staff recommended to City Council to sell the property at a price below market value. This is another real estate blunder the staff made in 2016. In essence, it would be a gift of public money through the sale of property for less than market value. The sale would enrich The Trade Desk’s shareholders on the back of Ventura’s taxpayers.

The final whiff of impropriety appeared in the handling of the finances. Ventura city staff was willing to accept $50,000 in escrow from The Trade Desk. The Trade Desk estimates it will spend $15 million to develop the property. The deposit works out to 0.3% of the total value of the project. Such a small deposit amount should have concerned city staff. One would think they would have learned from their prior mistakes. Not accepting an adequate deposit was a pitfall in the Brooks Institute situation.

EDITORS COMMENT

MOVING FORWARD RECOMMENDATIONS

Negotiations continue with The Trade Desk. Yet, the openness and transparency of this transaction remains in question.

To avoid any appearance of impropriety, Ventura should request new proposals for the property. The city must get an appraisal by an independent, certified commercial real estate appraiser. The sale price must be equal or higher than the appraised value. The city must make new bids public. And the final offer must generate a better return to Ventura’s citizens.

The successful bidder should make a good faith, earnest deposit. In the event the transaction doesn’t move forward, a deposit protects Ventura’s citizens. The deposit would cover any loss of value or cost to return the property to its current state.

Editors:

R. Alviani K. Corse T. Cook B. Frank

J. Tingstrom R. McCord S. Doll C. Kistner

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Oversight Of Measure O Is Untenable in Ventura

/in Newsletters/by VREG EditorsELECTION AFTERMATH

Measure O passed in Ventura. Now, comes the hard part: oversight.

2016 was a fascinating and challenging election year at all levels of government. The City of Ventura was no exception. Voters elected a new City Council Member and passed two City Charter amendments. Most remarkable of all, Ventura voters approved an increase in the sales tax. This will impact Ventura for 25 years.

The city staff and City Council promoted an extra 1/2 percent sales tax. The increase will raise another $10.8 million per year. That amounts to $270 million for city services over the next 25 years.

THE OVERSIGHT OF A NEW TAX IS UNTENABLE

The final vote count was 28,987 yes and 20,359 no votes. Measure O promises all voters strict oversight of the new money. Measure O mandates: 1) strict accountability 2) a citizens’ oversight committee 3) annual independent financial audits and 4) a public review of expenditures. Yet, the city hasn’t revealed its plan to put this strict oversight in place.

Ventura Councilmember Cheryl Heitmann

A lack of plan contradicts one councilwoman’s official position. She stated that her reelection was a signal from the voters. She believes voters think the City Council was spending the taxpayer’s money wisely. The 20,359 citizens that remember the Brooks Institute failure might disagree.

A LONG HISTORY OF BROKEN PROMISES IN VENTURA

Ventura citizens must hold City Government to its word. Promises are sometimes forgotten or even ignored when it comes to money. One example happened in 1991—26 years ago . City government promised to reduce water and waste water rates after the drought. The water and waste water rate increases they imposed were temporary. The drought ended. The rates never returned to their previous levels before the drought began. Once they got your money, the promises evaporated.It was also 26 years ago that our city promised desalination as a new water source, if voter approved. Venturans approve the city’s call for desalination, but nothing happened. Yet, Venturans still pay for State water rights because of the city’s nonfeasance.

Brooks Institute exposed the cracks in the city’s procedures.

Ten months ago, the city promised economic vitality when Brooks Institute moved downtown. Brooks Institute filed for bankruptcy. The project failed. The City Council and the city staff pointed fingers at each other for that debacle. There was plenty of blame to go around, though. The staff failed the Council by not performing its duties completely. The Council failed to ask the right questions before approving Brooks’ long term lease.

Afterwards, some City Council members reached a difficult conclusion. They realized the city staff lacks the expertise to assess complex real estate opportunities.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Congratulations On Measure O Passing! Now Let’s See You Do Something With It.

/in General News/by VREG EditorsMeasure O proponents used yard signs like this to turn out the vote.

We congratulate the voters and the City Council on Measure O passing.

Many people voted against this measure. That opposition was never about the extra tax money that could benefit our City. Instead, it was about the lack of trust in how this government would spend the money.

Citizens’ Oversight Committee Promised

Our opposition forced the proponents to promise that a citizens’ committee would oversee how the city spends this money.

Will city government keep that promise? Will the candidates keep their promise? Or, will the money flow toward the special interests that spent so much to get you to approve this new tax?

We’ll Monitor Measure O Closely For You

18,581 citizens voted against Measure O. Nonetheless, it passes.

Proponents promised clear accountability for how city officials spend the money.

We promise we will try to insure the city spends the money as it promised. The 18,581 people that voted against the measure deserve to know that much.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Brooks Institute Fiasco Exemplifies Ventura’s Bad Money Management

/in Newsletters/by VREG Editors“EVERYONE’S ENTITLED TO THEIR OWN OPINION, BUT NOT THEIR OWN FACTS” —Daniel Patrick Moynihan

Brooks Institute continues to be an issue

Ventura’s City Council’s bad deal with Brooks Institute exposes its lack of financial understanding. The Council

Brooks Institute closure exemplifies Ventura’s bad financial management.

and the city staff are scrambling to cover up those flaws. They’re feeding voters information designed to distract the public from the real issues. Ventura city staff believes it did enough due diligence. They’re trying to sell that opinion as fact in a Ventura Breeze article dated Sept. 13, 2016. The city staff’s facts ignore economic reality, though. Follow the money and you will always find the truth. Brooks Institute is no exception.

Everyone’s entitled to their own opinion, but not their own facts

Venturans for Responsible and Efficient Government (VREG) followed the money trail. VREG filed a Freedom of Information Act request with the city. The city provided the documents they evaluated to extend Brooks Institute a 46-month lease. What VREG learned reveals incompetence and lack of understanding.

W Brooks Institute is not an isolated problem; it’s a symptom of a larger problem. It shows the city council’s inability to manage taxpayer money. Brooks Institute surfaced at a time when the city is asking for another $270 million in taxes from Measure O.

Discovering The Cracks in the Foundation of the City’s Due Diligence

Brooks Institute exposed the cracks in the city’s procedures.

The city provided four foundational documents used to check Brooks Institute Holdings, LLC. The city staff believes these documents showed Brooks Institute was a good “risk.” In the private sector, these documents would have been insufficient. Here is why.

1) GP Homestay’s Commitment Letter Is Meaningless from a Financial Perspective

GP Homestay, Brooks Institute’s parent company, provided Ventura a ‘letter of guarantee.’ City Manager Mark Watkins announced this at the September 12, 2016 City Council meeting. The decision makers considered this meaningful in the decision to lease to Brooks. The letter has many shortcomings, though.

First, GP Homestay wrote the letter to a third party,not to the City of Ventura or any entity related to the Brooks Institute lease. GP Homestay wrote it to the WASC Senior College and University Commission on January 15, 2016. WASC Senior College and University Commission is an accreditation organization for Brooks Institute’s curriculum.

Second, nobody signed the letter. It is of no value to the City of Ventura as a basis for financial support, or to any of the other groups or businesses defrauded by Brooks.

Brooks Institute parent company, GPHomestay, took advantage of Ventura and its contractors.

Third, the contents of the letter are not something the city can depend on. The letter states, “Green Planet guarantees continued financial support for the proposed period of financial losses prior to reaching the break-even balance between revenues and expenses in 2020.”

This suggests two important facts. One, GP Homestay didn’t expect Brooks Institute Holdings, LLC to be profitable during the entire term of the lease. Two, after 2020, Green Planet could withdraw any financial support. These are hardly the assurances on which to base a 46-month lease, nor do they guarantee any payment.

2) Brooks Institute’s Loan Agreement with GP Homestay Arrives after the Fact

The city provided a loan agreement for $2.5 million dated March 28, 2016 between GP Homestay and Brooks Institute Holdings, LLC. This document is worthless from a financial perspective for several reasons.

First, the loan agreement is actually for a line of credit. There is nothing that indicates that the line of credit was ever signed or if Brooks Institute drew from it.

Second, nobody from GP Homestay signed the line of credit document. An unsigned document is worthless. It is unenforceable and not the basis for granting a 46-month lease.

Third, and most important, the date on the document is 33 days after the start of the signed lease. It could not have been available for the City Council to review while doing their due diligence.

The city approved the lease on February 22, 2016—more than a month before this document. So this document could not have factored into the decision to lease to Brooks Institute.

3) Dissecting Green Planet, Inc.’s Consolidated Opening Statement Balance Sheet

Green Planet, Inc. provided a consolidated statement to the city to support a 46-month lease. The statement dates back to June 16, 2015, making it eight months old at the time the city issued the lease.

Green Planet, Inc. consolidated statement includes six other corporations. To understand Brooks Institute Holdings, LLC, the city would have to separate out each of these corporations. That’s impossible with this statement. So, depending on this document for financial information would have been a waste of time. To cap it off, Green Planet, Inc. did not provide any guarantees to the city of the Lease Agreement or the construction period. This document doesn’t support the decision to lease space to Brooks Institute Holdings, LLC.

4) Brooks Institute Holdings, LLC Financial Documents Don’t Paint a Pretty Picture

The financial statements Brooks Institute Holdings, LLC provided lacked substance. First, the statements covered four months. Brooks Institute Holdings, LLC only existed since March 2, 2015.

Upon examining the financial statements, several irregularities signaled danger and demanded further questions. For instance, Brooks Institute Holdings, LLC’s available cash. Brooks would have had only $403,805 in cash if it paid all current liabilities. The balance sheet showed a cash balance of $2,750,598 and Current Liabilities of $2,346,793.

This statement was seven months old when the City Council discussed the lease agreement. Yet the city didn’t verify Brooks Institute’s available cash by demanding bank statements. The city had no way to know how much cash Brooks had available.

The Statement of Income showed a Net Operating Loss of $21,531. GP Homestay expected this loss and future losses until the year 2020, as they stated in their letter. Yet, the Statement of Income is misleading. The Statement of Income shows Net Income of $1,738,026. This is the result of the acquisition of the school valued at $1,759,557. The only reason it showed a Net Income was due to the value it placed on acquiring itself. An acquisition is a one-time, extraordinary event. It does not show true profitability.

The Scramble to Cover Up the Flaws

The city began spinning the story soon after Brooks Institute closed its doors. First, there was City Manager Mark Watkins’ public mea culpa in the Ventura County Star. In it, he stated the city erred on execution on Brooks Institute by not collecting rents and fees. Next, there was an article in the Ventura Breeze by “City Staff” (whoever that is). It read, “As part of the City’s due diligence in determining the viability of the lease, the City was provided access to Brooks’ and its parent company’s (GPHomestay) confidential financial information. Based on that review it was determined that Brooks was solvent.” City Staff hoped nobody would discover the truth by examining the financial statements. Finally, there is Councilmember Cheryl Heitmann’s plea. She urged the city to get out in front of the problem at the September 12, 2016 council. She reckoned citizens were forming their own opinions without the city’s input.

The city’s rush to move Brooks Institute downtown forced city staff to cut corners.

The truth will out. The city was eager to do the lease with Brooks Institute. The city did a minimal review to rush the deal. After the fact, the City Manager admitted errors in the process. He stopped short of saying the city approved the lease without proper supporting documents. And the city failed to ask and answer many questions before it signed the lease. Even a cursory examination revealed Brooks had only $403,805 in cash. Brooks lacked enough funds to remodel the City site, let alone several other locations.

This situation will take years to resolve. Here’s what we do know now. Brooks Institute closed. The city has unpaid rents. Brooks stiffed contractors for tenant improvements they completed. The city will have to renovate the buildings Brooks leased to lease them to someone else. Brooks Institute Holdings, LLC didn’t couldn’t fulfill its obligations on the 46-month lease agreement. And, neither the city staff or the City Council researched enough before issuing a long-term lease agreement.

These are the facts. The city is trying to distract the public by zeroing in on the amount of money the city lost. The City Council and the City Manager want voters to believe the losses were $70,000. That amount of money is significant in itself. It may not be the full extent of the city’s exposure to losses, though. The real exposure is closer to $1,095,000. There is the $70,000 in lost rents from Brooks Institute. There is also the $825,000 mechanic’s lien by the contractors that the city refuses to pay. There will likely be legal costs to defend that position. Finally, it will cost $200,000 to return the sites into leasable condition according to Mark Watkins.

Editor’s Comments

The city played fast and loose with taxpayer money on the Brooks Institute deal. The city made several public apologies. They sympathized with the Brooks Institute students and facility over their loss. Yet, they admitted no wrongdoing. There was no apology to the City Council for making them look foolish and uninformed. But, worst of all, the city didn’t apologize to the taxpayers. It’s the taxpayers who pay for the city’s mistakes.

With or without an apology, though, one thing remains clear. The city has mismanaged taxpayer money on Brooks Institute. The situation demonstrates city staff and City Council’s incompetence or lack of understanding. So, it would be imprudent or foolhardy to trust this City Council with another $270 million through Measure O. Don’t give city government more money until they show they can spend the money they have. Vote No on O.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.