What You Need To Know About The Schools And Communities First Initiative

“Some taxpayers close their eyes, some stop their ears, some shut their mouth, but all pay through the nose.”

—F.J. Raymond

The pandemic has impacted everyone and everything. Businesses large and small struggle, and while it has probably not come to your attention, this November, a proposed ballot measure aims to increase the cost of living for everyone. Under the guise of “helping our children,” the legislature placed The Schools and Communities First (initiative 19-0008) on the ballot. If approved, this will push prices higher for all residents.

Today’s property tax regulations — Proposition 13

On June 6, 1978, the voters passed Proposition 13 reducing property tax rates on homes and businesses by 57%. That happened because legislative bodies were raising taxes aggressively, the only limits being a legislator’s imagination on how to devise the next tax increase. So, Prop 13 rolled back and froze the taxable value to the 1976 level. Any increases were limited to no more than 2% per year as long as the owner did not sell it. Once sold, assessors re-valued the property at 1% of the sale price, and the 2% yearly cap applied to future years.

Changing Prop 13 Through The Schools and Communities First Initiative

The Schools and Communities First Initiative seeks to repeal Proposition 13 protections for commercial and industrial property owners. Every business, commercial and industrial property will be reassessed every three years and taxes assessed based upon “the fair market value” or the “income approach “of valuation, whichever is higher. They project it will raise $12 billion per year in new tax revenue.

Whether owned by a large corporation or a family, the initiative would be a massive tax increase. It will affect office buildings, retail stores, shopping malls, movie theaters, gas stations, supermarkets, factories, warehouses, self-storage facilities, auto dealerships, car washes, restaurants, hotels and every other job-creating business in the state. Even small businesses that lease space in a strip mall would see their operating costs jump sharply due to tax increases passed through from landlord to tenant.

Whether owned by a large corporation or a family, the initiative would be a massive tax increase. It will affect office buildings, retail stores, shopping malls, movie theaters, gas stations, supermarkets, factories, warehouses, self-storage facilities, auto dealerships, car washes, restaurants, hotels and every other job-creating business in the state. Even small businesses that lease space in a strip mall would see their operating costs jump sharply due to tax increases passed through from landlord to tenant.

Many public unions support this tax Initiative — the California Teachers Association (CTA), the Service Employees International Union (SEIU), California Tax on Commercial and Industrial Properties for Education, Education and Local Government Funding Initiatives (2020).

What The Proponents Say Is Wrong

Advocates argue that this is only a “split roll,” and it is “for the children.” Split roll is a shorthand term for proposed changes to Proposition 13 that would allow higher property tax assessments on a commercial property, but would not change for residential property.

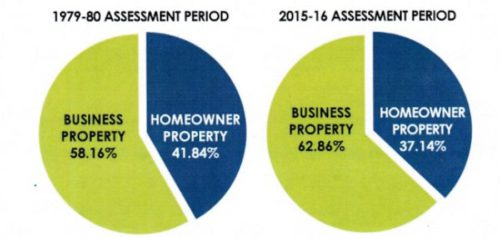

Another argument advocates make is that corporations have benefited more than homeowners under Proposition 13. They assert that the business property tax-burden shifts from companies to homeowners; they call a “property tax loophole.” They say passing The Schools and Communities First Initiative closes this loophole.

The suggestion that there has been an “enormous shift” is untrue. Displayed is a chart showing the percentage of tax paid by business versus individuals in 1979-80 and then in 2015-2016. Using data obtained from the California State Board of Equalization and the California Legislative Analysis Office, the following pie charts show business property owners pay more in taxes now than they did 40 years ago:

Source: California Tax Foundation

How You Will Be Affected If This Passes

All consumer costs will jump. Business property owners will pass the tax increase to consumers in the form of higher prices for everything, for all goods and services.

- Chain stores will pass on the costs to consumers and survive, maybe. Five hundred companies have filed for Chapter 11 since the pandemic began.

- Shopping malls like the Pacific View Mall, where a retail tenant typically pays a Triple Net Lease (N-N-N),meaning the tenant pays the taxes. In this instance, property owners will not pay the higher taxes, as the proponents would lead you to believe. Instead, store owners will pay the tax and pass that expense on to their customers with higher prices. If not, they will fail.

- If you rent a self-storage unit, pay attention. The self-storage industry is very concerned about the effect on its business. The industry calls the tax disastrous. Who are the most frequent users of self-storage units? Renters!

- Gas Stations. If you drive, Schools and Communities First Initiative will hurt you. Retail gas stations would see price hikes and closures. A quick review of gas stations for sale shows that the split roll will negatively impact many of them. Gas prices will go up accordingly.

Opponents to the Schools and Communities First Initiative

A list of the opponents to the Schools and Communities First Initiative includes the Howard Jarvis Taxpayers Association, the Ventura County Taxpayers Association, the California Taxpayers Association, the California Chamber of Commerce, the California Farm Bureau, the California Business Properties Association and the Western Manufactured Housing Communities Association.

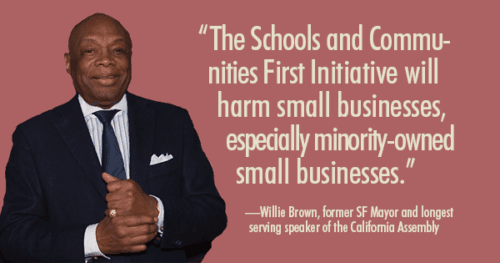

Willie Brown, former San Francisco mayor and the longest-serving Speaker of the California Assembly, also opposes this measure and stated: “…that the Schools and Communities First Initiative will harm small businesses, especially minority-owned small businesses.”

Willie Brown, former San Francisco mayor and the longest-serving Speaker of the California Assembly, also opposes this measure and stated: “…that the Schools and Communities First Initiative will harm small businesses, especially minority-owned small businesses.”

David Kline, vice president of communications and research for the California Taxpayers Association in Sacramento, said, “The last thing this state needs is higher taxes, and especially a tax that would increase the cost of everything we buy in California.”

The California Assessors’ Association (CAA) is also in opposition. Larry Stone, Santa Clara County’s assessor, said, “it is impossible to implement as written.” CAA President Don Gaekle, the assessor for Stanislaus County, wrote in a letter to lawmakers, “Current local budgetary realities will make the implementation of the initiative extremely difficult.”

Editors Comments

The high cost of living in California would be pushed even higher by this massive tax increase. Passing the Schools And Communities First Initiative would hit every business in the state at the same time.

Don’t be fooled when “split roll” advocates say that it just hits businesses. When their costs go up, so do the prices you pay for goods and services.

The “split roll” would make California’s brick-and-mortar businesses increasingly uncompetitive with online companies based in other states where costs are far lower. It would also accelerate business flight out of California.

Advocates of a “split roll” say it merely closes a “loophole.” They maintain that voters never intended Proposition 13 to apply to commercial property, but this isn’t true.

California has had a single or “unified” roll, treating all property the same, since the 1800s! Proposition 13 didn’t change that.

The government employees charged with implementing the Schools And Communities First Initiative say the law is untenable as written. They would need extra appraisers and support staff to do what the law requires, thereby increasing the government’s cost and adding to California’s pension burden.

Taxes are already too high in California, yet the demand for more is unrelenting. Read past the Schools And Communities First name on the ballot. Look beyond the rhetoric to understand the real costs to you.

Learn Where Your City Councilmember Stands On The Schools and Communities First Initiative

Below you’ll find the photos of our current City Council. Click on any Councilmember’s photo and you’ll open your email program ready to write directly to that Councilmember.

|

|

|

|

|

|

|

|

|

|

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

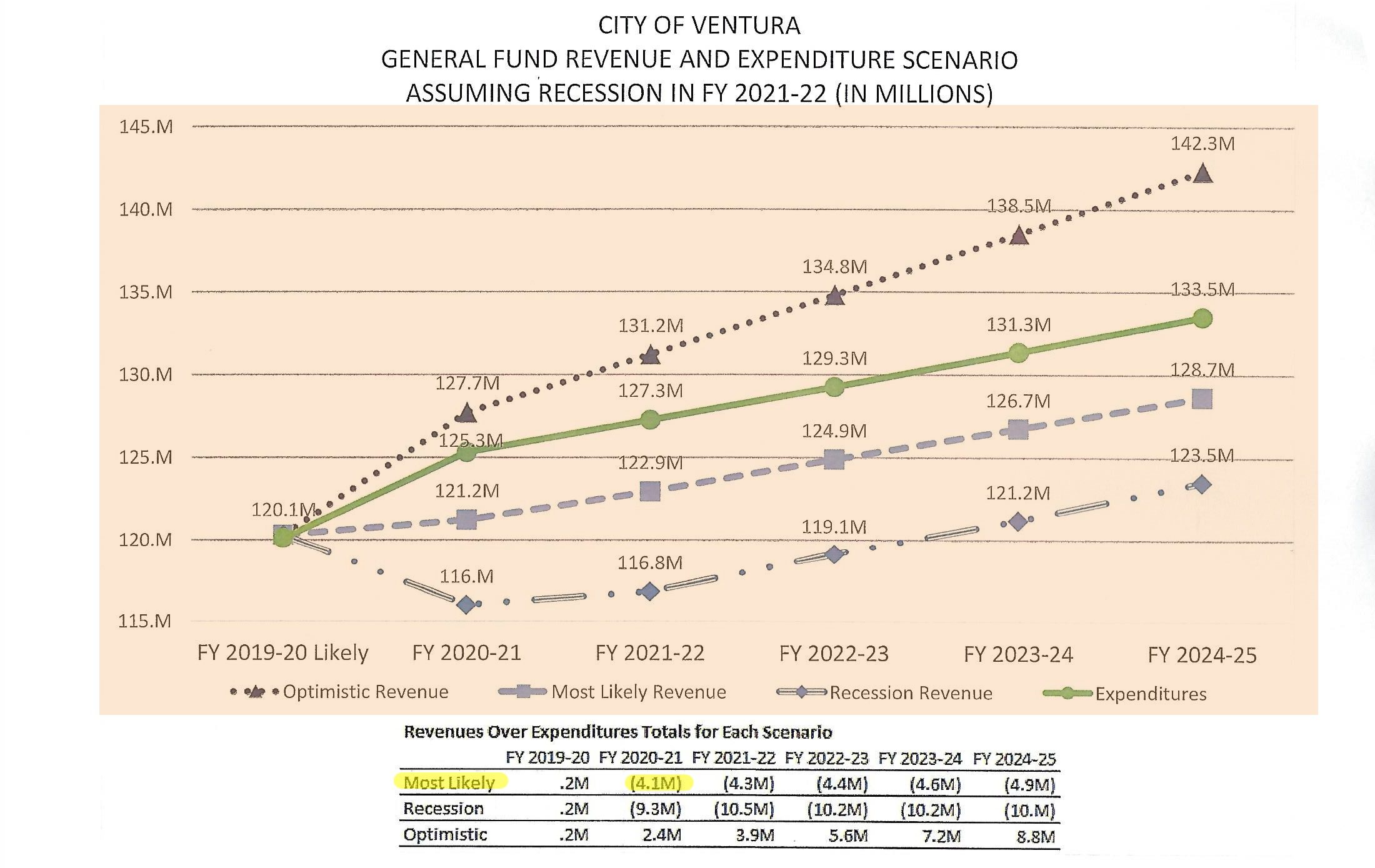

Today’s Council is still operating on the 2019-2020 budget that shows everything is fine. In six months we will be in a new budget cycle, how does that look? The city staff projects a “most likely” budget scenario that will have a shortfall of $4.1M. How can the seven members of the City Council take action to save jobs and essential services for the citizens of Ventura?

Today’s Council is still operating on the 2019-2020 budget that shows everything is fine. In six months we will be in a new budget cycle, how does that look? The city staff projects a “most likely” budget scenario that will have a shortfall of $4.1M. How can the seven members of the City Council take action to save jobs and essential services for the citizens of Ventura?

Reduce overtime for city employees. The largest single expense category in the city is staff salaries and benefits. Reducing overtime might save as much as $5.6 million in the budget.

Reduce overtime for city employees. The largest single expense category in the city is staff salaries and benefits. Reducing overtime might save as much as $5.6 million in the budget. Review the money Ventura pays to support the Ventura County Museum. This option will save $250,000 per year.

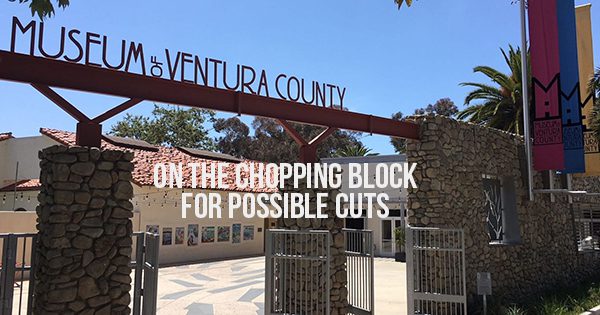

Review the money Ventura pays to support the Ventura County Museum. This option will save $250,000 per year.  Evaluate Community Granting Programs. The amount of potential savings is not listed. This category includes programs like Community Access Partners (CAPS). CAPS received

Evaluate Community Granting Programs. The amount of potential savings is not listed. This category includes programs like Community Access Partners (CAPS). CAPS received