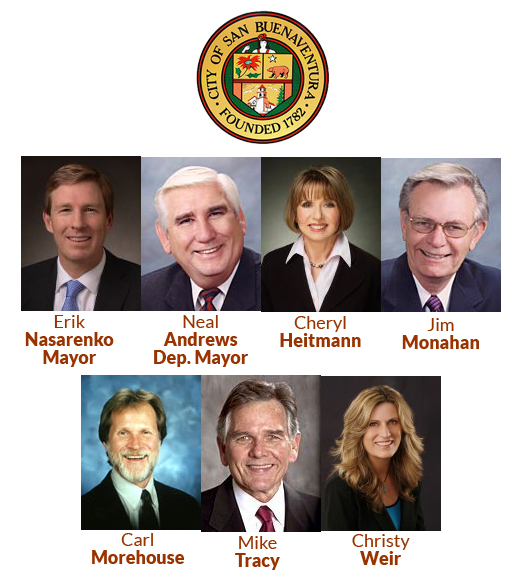

VENTURA CITY COUNCIL SPENDS $118,000 TO ASK VOTERS TO INCREASE TAXES – AGAIN

On April 14, 2015, the City Council directed the City Manager to conduct a “community survey” to gauge interest in future revenue options (government speak for raise taxes) to support community services for a fee of $38,000. They did that and spent your money for a poll.

Ventura paid $38,000 to high-priced consultants to “sell” a sales tax increase to voters.

On September 28, 2015, the City Council listened to the expert concerning his interpretation of the answers in the poll, and whether the voters, in his paid opinion would support a sales tax increase of 1/2% or 1% over the present rate of 7.25%.

Given the nature of the questions in the poll (noted below) it was no surprise that he opined that six in ten “perceive the City has at least some need for additional funds for city services. However, only 22% recognized a ‘great need’ and only one-third would definitely vote yes.

One-third however does not get the Council to the required majority in an election, so the expert said that “educational statements lead to a 7% overall gain in support for the one-cent measure and an 8% overall gain in support for a one-half cent measure”. In other words, the voters need to be told (persuaded) what they need.

The paid consultant, of course, was available to provide the needed education to attract more voters at a cost of $80,000. The Council again voted to spend your money because you need “education”.

The tax increase has not as yet been put on the ballot but the measure will be called – CITY OF VENTURA ESSENTIAL SERVICES PROTECTION MEASURE – if the Council follows the expert’s advice.

RELYING ON A BAD POLL, AGAIN

As is the case with most poorly worded surveys which include ambiguous questions or questions that are too general in their nature, our city council paid for a very misleading assessment. This poll implies that new taxes will go toward any and all of the suggested purposes in the survey, with no details or guarantees.

Interestingly enough, the poll that the City of Ventura commissioned, is quoted in the Ventura Star paper, as asking if the citizens would be willing to support a tax increase, if it provided:

- protection of local water supplies

- keep all fire stations open

- protect local beaches, rivers and coastal waters from pollution

- maintain and improve fire, police and paramedic emergency response

- maintain essential city services

- improve services for seniors, the disabled and veterans

Past City Councils have relied upon poor surveys before and have lost on elections both times in the past.

HOW DID WE GET STARTED DOWN THIS PATH AGAIN?

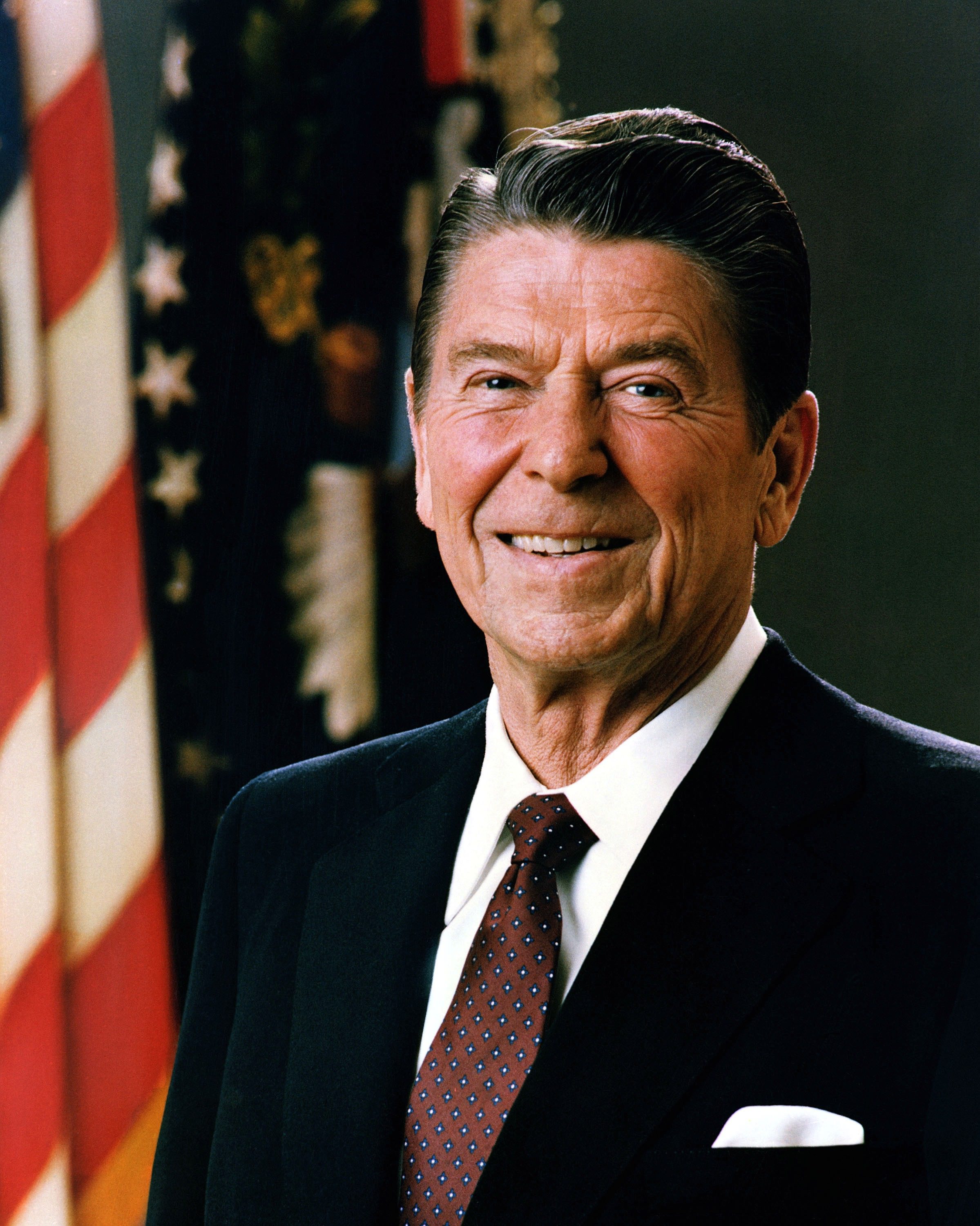

Ventura now has a new Mayor who has only been in Ventura just over 5 years, coming from Los Angeles. With him comes a desire to tax the citizens of Ventura partly because taxes are lower than Los Angeles and because the Ventura City Council can find more ways to spend more money. However, this desire to gather more tax money is once again being sold to Venturans under the disguise of “keep funds local”.

A SMOKE SCREEN

Before we get too far ahead of ourselves, several of these items, such as water supply, rivers, beaches, seniors, disabled and veterans are already being paid for by county, state and federal agencies.

Our Mayor has started a dialog to have the citizens believe this tax will help our aging water system and our pier.

The mayor and Ventura City Council blow smoke about Ventura’s need for more taxes after consultants deliver voter poll findings.

This is an effort to deceive the voters into believing that more taxes are needed for our water system. Ventura Water Department, independent of the city general fund, maintains our water system to the tune of a recent 34% increase in water rates over that last two years. After a 34% increase in water rates, Ventura has the funds for our aging water system.

With regard to the pier, there is over one million dollars in the “pier fund” to repair the pier. The community needs to understand that the pier is protected with an insurance policy that will have it repaired. The policy calls for a onetime occurrence insurance with a $100,000 deductible for each major occurrence. The $1.0 million in the fund, which is money that came from the community, not the city budget, is available to pay this $100,000 deductible each time it is needed. Therefore, no part of the sales tax dollars is needed for the pier.

MORE TAXES ARE NOT ALWAYS THE ANSWER

The other argument most often used to increase Sales Tax rates is that Ventura is lower than other cities, implying that Ventura is falling behind. The only two cities in Ventura County with an 8% sales tax rate are Oxnard and Port Hueneme. Aren’t both of these cities struggling with budget deficits? Los Angeles is at 9.00% for their sales tax. We cannot compare our needs to Los Angeles.

REVENUES ARE ALREADY UP

So let’s first discuss the need for more funds. The truth is that over the last 2 years, the City of Ventura property taxes have increased by 4.0% ($18,479,513 to $19,235,000). Also over the same two years, the City of Ventura sales tax revenue has increased by 9.5% ($16,134,075 to $17, 674,715). Therefore, revenues for the City of Ventura have continued to rise and as our new Mayor has said “we are living within our means and we have a balanced budget”.

WE HAVE THE REVENUE. IT’S A SPENDING PROBLEM.

Now let’s point to the real reason more taxes are being suggested. In 2015/2016, even after the employees’ contributions have been made, the employers’ contributions for the SEIU and Public Safety employees have increased from $15,061,523 to $16,079,104 for a net increase of $1,017,581. And, it is going to get worse.

Therefore, it does not look like the amount that the employees are contributing is keeping up with the cost, investment and the demand by the current and future retirees. Therefore, the percentage of the total city budget is continually going towards increased retirement costs and not services. Employees need to contribute a higher percentage toward their own retirement.

SO WHAT IS THE ALTERNATIVE SOLUTION TO THE PROBLEM?

Using our Mayor’s own words from his 2013 campaign:

Mayor Erik Nasarenko commissioned the voter poll on taxes.

1) When asked how you plan to pay for to improve streets, public safety, water resources, attracting new business, parks, schools and city services his answer was: “By growing the economy… the city must attract and retain businesses that will increase its sales tax base.”

2) When asked what the role of the city is to attract a better economic vitality and his answer was: “The city can bring economic vitality to Ventura by keeping it safe and clean, creating a business-friendly culture at city hall, making sensible, cost-effective loans to businesses, and by promoting trade and tourism both locally and globally”. There is nothing said here about increasing taxes upon the citizens further.

3) When asked whom he would represent, his answer was: “City residents. Without whom, there would be no tax base—property, sales or otherwise—to provide the core services necessary to support the city”. You shouldn’t be promoting to increasing taxes upon your existing tax base when you have not first tried to introduce your plan for attracting and retaining business that will increase its sales tax base.

4) Where is the action that he promised such as: “As Councilmember, I would like to make Focus Area 1 a top priority, bringing to the Auto Center area a destination retail establishment, like a Bass Pro Shop, and possibly a hotel to support the Players Club casino.”

In our new Mayor’s own words, economic vitality through increasing the business base is the top priority. He led voters to believe that his position was to expand the tax base as a better alternative than increasing the tax rate. We should keep him to his word.

Editors:

R. Alviani, K. Corse, T. Cook

J. Tingstrom, R. McCord, S. Doll

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.