Special Interests Line Up For Their Share Of Measure O

“IT ISN’T WHAT WE DON’T KNOW THAT GIVES US TROUBLE, IT’S WHAT WE KNOW THAT AIN’T SO”—Will Rodgers

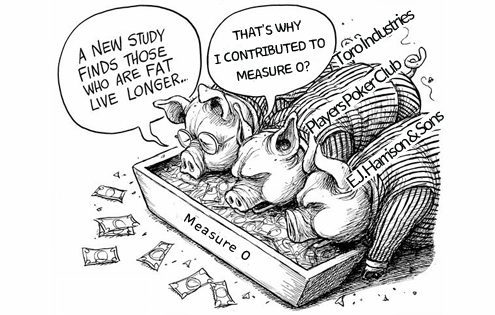

FEEDING AT THE PUBLIC TROUGH

The Yes on Measure O Committee reported contributions of $30,000. Of that, over $10,000 has been spent with a public relations firm to convince you to vote yes. (This is in addition to the $144,000 the city has already spent on consultants and a 4-color brochure). They argument has been that everything is urgent and there will be money for everyone, for everything.

Follow the money contributed to Measure O. You’ll find many companies and individuals that work for the city.

Very large donors included individuals in city government. The City Manager, Mark Watkins, makes $281,000 a year and the Chief of Police, Ken Corney, $313,000 a year. Each contributed $1,000.

Mayor Nasarenko, a public prosecutor, who announced that this tax measure would be his political legacy, also contributed $2,000. Others included Councilman and former police chief, Mike Tracy ($1,000), Ventura Water General Manager Shana Epstein ($500) and Interim Parks and Recreation Director Nancy O’Connor ($750) and Assistant City Manager, Dan Paranick ($1,000)

Contributions from government employees are not a surprise. Those who depend on tax money for their wonderful salaries and benefits, see this tax as protecting their salaries and benefits. To do that they need more tax money.

Contributions from private special interests should also be a red flag. John Ashkar, a developer doing business as Pacific Heritage Communities ($5,000), Toro Industries, a pavement contractor ($10,000), Tri-Counties Labor Council PAC, a labor union organization ($5,000) and Service Employees International Union Local 721 ($2,500). These are companies and unions that feed off our tax dollars for their own benefit. They have had their snouts in the public trough for so long they make no effort to hide their self-interest.

Toro Industries does street and repair work. They have contributed $10,000. A formal report by Public Works, called the Pavement Maintenance Plan for fiscal years 2017-2021, concludes that 70% of our streets are in good to excellent condition. The city also plans to spend $5,240,648 in 2016 and $6,372,869 in 2017 on street repairs. That totals over $11 million dollars, without increased taxes. One of the major arguments for Measure O has been the “urgent” need more money for street and road repairs. This gives, at best, the perception of a conflict of interest. At its worst, this looks like an attempt to buy an election.

There are also two labor unions contributing $7,500 toward a publicity campaign to convince you to vote yes. What possible motive could they have in contributing $7,500 to the “Yes on O” campaign?

Citizens do not get a vote on benefits and contracts. We pretend that by voting for a City Council, we have a voice in such matters. The reality is that we do not. If you believe otherwise ask yourself, “Why would the City Council increase the Fire Departments retirement benefits by 50% and make it retroactive to the beginning of time?” They could have made this action effective from that moment forward but they did not. By voting as the City Council did, it created an instant $80 million dollar unfunded debt foisted on the taxpayers.

COMMON SENSE

By the time you receive this letter you will have your Voter Pamphlet and, maybe, your ballot. How you vote on all the tax measures that will impact your family? We suggest common sense and what is in your best interest.

CONSIDER THE FACTS WHEN YOU GO TO THE POLLS

Consider carefully the arguments in the voter pamphlet and all of the facts before you decide and ask yourself if you have doubts. We believe that MEASURE O IS A BAD LAW and urge a no vote. Here is why:

- Measure O is for 25 years. This is a LIFETIME. It will never expire as promised.

- THERE ARE NO RESTRICTIONS on how this money is spent. City Councils can and will change spending at any time. This is ripe for City Council’s broken promises and having funds redirected.

- The guarantee of a Citizens Review Committee (CRC) is a lure for the gullible. The City Council appoints the CRC and any accounting reports will be after the city spends the money. They will not have any budget control. They will not be order the Council to pay the money back. The City Council will retain the power to appoint and spend.

- The City doesn’t need more taxes to operate our City. The Council has a balanced budget and has stated publicly that the current revenue is sufficient to operate. We have a balanced budget.

- They even added funds to reserves and approved 4.50% raises and $1,500 bonuses for over 270 employees making over $100,000.

-

Companies that do business with the city contributed heavily to pass Measure O.

Ventura City Council now claims everything’s “urgent”. NOT TRUE. They want another $270,000,000 tax without prioritizing.

- Over the last 2 years, the City of Ventura’s property taxes have increased by 4.0% and sales tax revenues have increased by 9.5%. The result is in 2017; the general fund revenue will be $104 million, the highest in Ventura’s history. Reserves have also increased to $12.5 million. Given the surfeit of new tax revenue repairing streets and public safety should already have first priority, not public art or low cost subsidized housing for everyone.

- Polls implied that funds would be for rivers, beaches and veterans. Federal, state and bond budgets pay for rivers, beaches and veterans.

- Recently increased WATER RATES of OVER 42% fund water and wastewater issues and cash reserves over $500,000 have accumulated. In fact the Water is planning to spend $17,000,000 to replace water meters with new digital meters. We don’t need new taxes for water infrastructure.

- The entire city is 150 is years old but the majority of the infrastructure business and homes were built after 1950. The suggestion that because the City is 150 years old and falling apart, is pure emotional campaign rhetoric.

- In the Voter Information Pamphlet, the City Attorney, in his Impartial Analysis, states that Measure O has the provision that ‘Suspends the tax, after notice to the State, should the State divert this revenue for State purposes’. How many times have the supporters and Mayor said ‘By law, the State cannot touch Measure O funds’? Guess they lied to us again.

MEASURE O IS AN ASSAULT ON MIDDLE INCOME FAMILIES

Up and down the state, taxpayers are the targets of tax raisers. On local ballots this November, voters face billions of dollars in new taxes and bond measures. There are 228 local tax measures representing a cumulative tax of $3 billion per year. That is on top of what we already pay. Measure “O” in the City of Ventura is one of those measures. California has the highest sales taxes of any state in the union. Also on the ballot is a ½% Transportation tax, and Ventura Unified School Board property tax.

A sales tax is regressive and it has a substantial impact on everything a family buys – clothes, cars, toys, you name it. The lower your income, the greater percentage of that income you pay in taxes. The average income for a family in the Ventura is $66,485.

If your are working 40 to 60 hours per week or are a senior citizen on a fixed retirement income, think carefully about voting for a tax increase because it will be giving local government more of your money. Remember also that those pushing for you to pay more taxes are in a government position. 503 full time City employees receive an average pay and benefits of $103,549. Of that number, 70 employees (13%) make over $200,000 per year and another 167 make over $150,000 per year.

THE TRUST ISSUE AND PAST SPENDING

Trust of this government is a looming question. Do you trust this City government to effectively use your tax dollars in a prudent manner? They have a spending problem.

In deciding on how you will vote ask yourself, what is there about a promise of future prudence and strict accountability that gives you hope that the mistakes over the last 25 years will not be repeated in the next 25 years. As a reminder here is a list of the losses just over the last 10 years.

- $2.5m WAV project, never repaid. $1 million of that moved from water rate payer money to the General Fund in the name of “Art”.

- $1.0m spent on a plan to narrow Victoria. Spent then abandoned.

- $1.2m for 911 taxes. Money collected never refunded

- $0m diverted at the expense of the internal service funds.

- $10.0m lost investments with Lehman and WAMU, poor City Council oversight

- $1.2m annually for 50% fire retirement increase

- By making The fire departments retirement retroactive to the beginning of time, this immediately increased liability to the City another $80 million dollars overnight

- $5.0m to promote as Art City Ventura

- $1.2m twice sold parking spaces settlement in the downtown parking structure

- Brooks Institute lease without due diligence, losing thousand and leaving contractor with $825,000 in unpaid liens

EDITORS COMMENT

Budget surpluses and tax revenues are growing. Ventura City Government, like citizens, must live within their means. This FOREVER tax is UNACCEPTABLE. There is no legitimate reason to tax us $270,000,000 more.

Editors:

B. Alviani, K. Corse, T. Cook, B. Berry

J. Tingstrom, R. McCord, S. Doll B. Frank

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.