Time To Consider A Volunteer Fire Department For Ventura

“Politicians in America exploit economic illiteracy” —Walter Williams, Professor Economics

PUBLIC EMPLOYEE PENSION TRANSPARENCY ACT

We previously reported that there is a bill is currently pending in Congress (HR567) and the Senate (S347) encouraging governments at all levels to switch from a “defined benefit” plan to a “defined contribution” plan by requiring public entities to reveal to the voters the true magnitude of the unfunded liabilities of the public pension plans.

In California CALPERS continues to portray a rosy investment return. The staff at CALPERS recommended a change in the assumption of how much our City pensions investments will make in the future from 7.75% to 7.5%. This went to committee on March 15, 2011. This new direction, had it been adopted would have moved the pension fund on a path to solvency and economic reality. It didn’t happen. The CALPERS committee did not want to pass on the annual increased expenses to the cities that such a modification would cause given their current budget strains. Ventura is of course content to ignore this. You know, “What is a poor mother to do”. In the City of Ventura we owe $67,488,000. Twice that if a more realistic investment return of 3.50% is used.

These Federal bills, called the PUBLIC EMPLOYEE PENSION TRANSPARENCY ACT, would require States and municipalities to report their liabilities to the United States Treasury. The HR bill was sponsored by Representative Darin Nunes, Darrell Issa, and Paul Ryan with Congressman Elton Gallegly acting as a co-sponsor.

If adopted state and local governments will be “encouraged” to switch to defined contribution plans. While they are being “encouraged” they will have to reveal the true magnitude of their unfunded liabilities to their citizens. No more off the balance sheet reporting. This new legislation will require that they report liabilities to the U.S. Treasury using their own glowing investment forecasts as well as a more realistic Treasury bond rate. If the City of Ventura is forced to use a Treasury bond rate of 3.5% our unfunded pension obligation would double to $134,976,000.

THE FIREFIGHTER BENEFITS CONTRACT

Considering a volunteer fire department hybrid may help Ventura’s rising pension costs.

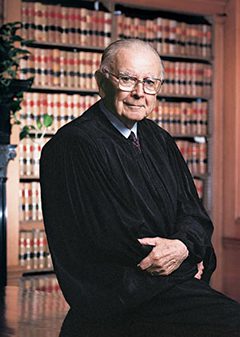

In the fall of 2008 that Ventura fire fighter benefits and pension contract was modified by the City Council. This was treated in our September, 2008 issue.

“In a vote of 4 to 3 the council approved the Memorandum of Agreement and the new pension contract with the firefighters of this city giving them a pension equal to 3% of their highest salary times the number of years in service plus all medical, dental. The yeas were Councilmen Fulton, Brennan, Summers and Monahan. The neighs were Mayor Weir, Councilmen Andrews and Morehouse. It should be of grave concern to all when one councilman says, before he cast his “NO” vote — “I HAVE GRAVE CONCERNS TO COMMIT WHEN WE DON’T KNOW WHERE THE FUNDS WILL COME FROM”.

“I Have Grave Concerns To Commit When We Don’t Know Where The Funds Will Come From”.

Mayor Fulton and Councilmembers Brennan, Monahan and Summers were thus responsible for increasing the firefighter pension in the fall of 2008 so that these folks could retire with 3% at age 55[1]. Their actions increase our unfunded pension debt by $1.2 million or more annually.

Since then the pension contracts for all City employees have come up for renewal. On Tuesday January 16, 2011, the Ventura City Council approved new labor contracts with the Ventura Police Officers, Police Management and the employees represented by the SEIU. The vote was 5-2 in favor of the agreements. Councilman Andrews and Councilwoman Weir voted against approval. The decision of the other five – Brennan, Fulton, Monahan, Morehouse and Tracy was in favor.

The agreement with the Fire Department union is still in closed negotiations, which, of course, are not made public. Many criticized the past decision of the Council in approving the employment contracts for the Ventura Police Officers and Police Management, not the least of which was Council Member Weir, who rejected the proposal and stated “Fiscally, the city needs more than this right now.” and Council Member Neil Andrews said the agreements “simply don’t go far enough.” The SEIU, who agreed to a lower 2nd tier retirement plan (2% @ 60) also agreed to a salary average of the three highest years in calculating their pension entitlement for all new hires. The Ventura Police Officers and Police Management stuck to 3% @ 55 and the single highest year for all new hires.

ANOTHER POINT OF VIEW

[The case for a volunteer Fire Department program]

Due to the present Firefighter negotiations, this next article is timely and worth greater consideration.

Municipal governments in other states are beginning to come to grips with bloated payroll and pension demands of public employee — fire unions and have handed these folks their walking papers in favor of a volunteer fire department. There is a persuasive argument to be made in favor of such a step, or some hybrid of that concept so that the community becomes more involved and vested in community safety. The following is summary of study performed by Bill Knox, former candidate for the Ventura City Council. The complete 10-page report, complete with comparison charts and footnote links, is available upon request. (Simply email vregventura@gmail.com)

Solutions for Ventura’s Fire Department

[The Case For A Volunteer Fire Department]

Ventura is in the midst of an unprecedented reduction in public safety services. Mounting overtime costs, enormous pension liabilities and shrinking revenue streams have resulted in the closing of a fire station and elimination of firefighter positions. Using volunteer firefighters to assist professionals could save the city millions annually and dramatically improve public safety.

Response Times

Understaffing at Ventura’s fire stations has resulted in substandard emergency response times. According to national standards, firefighters should respond to emergency calls within five minutes. This time frame is critical in that resuscitation from cardiac arrest after five minutes typically results in brain injury, coma or death. As a result of inadequate staffing, the department fails, on average, to meet the response standard over 62% of the time. With the elimination of three firefighter positions and the fire’s department’s plan aimed at reducing sworn staff positions by nine, response times are anticipated to increase by an additional 30%.

As a result of inadequate staffing, the department fails, on average, to meet the response standard over 62% of the time.

Lack of Funds

The fire department’s budget for 2010-2011 is $14.5 million. The city closed station No. 4 in hopes of reducing costly overtime pay. In 2009, the city paid $1,700,000, (nearly 12% of this year’s budget) in overtime payments. Employees with one year of experience receive a compensation package well in excess of $98,000. Senior-level employees cost exponentially more. In addition, the city of Ventura has an unfunded pension obligation of more than $50,000,000. Taken together, the fire department’s budget is stretched to the limit and the city simply cannot afford to maintain, much less expand, the professional force.

Volunteers

Ventura should consider a volunteer fire department program similar to Volunteer policing.

The Ventura Police Department uses 44 volunteers to supplement the professional force. Volunteers have donated over 40,000 hours of their time to serve the city. If 44 volunteers each donated 48 hours per month to the fire department the city could save more than $1.06 million in basic compensation costs. If overtime was eliminated, the savings would amount to nearly $3 million annually! If law enforcement supplements its professional force with volunteers to improve public safety, reduce costs and partially compensate for reductions in its budget, there is no reason that the fire department cannot achieve similar if not better results with a well crafted and executed plan.

If law enforcement supplements its professional force with volunteers why can’t the fire department achieve similar results?

Most US Fire Departments Use Volunteer Fire Fighters

According to the Federal Emergency Management Agency (FEMA), over 92% of fire departments in the United States use volunteer firefighters, either exclusively or on a supplemental basis. California cities such as Chico, Fillmore, Santa Ana, Santa Clara, Santa Paula, Stockton, Compton, Rohnert Park, Turlock and many more successfully use volunteers to supplement their professional forces. These communities receive outstanding results and substantial cost savings with their highly trained and dedicated volunteer forces. If Ventura created a supplemental volunteer fire fighting force modeled after any one of these communities, it would save between $2.5 and $3 million annually.

If Ventura created a supplemental volunteer fire fighting force, it would save between $2.5 and $3 million annually.

Volunteer firefighters do come with a minor cost, but not a salary or massive pension obligation. The city would still need to cover costs of training and equipment; costs already incurred by the city for its professional firefighters. To protect the city’s investment, the volunteer should be required to serve a minimum term or pay back the costs associated with certification and training.

Volunteers are a viable option to ensure a timely response to emergency calls, to reopen station No. 4 and possibly staff additional stations, like a much need station in Ventura’s harbor. Volunteers, like professionals, must complete mandatory training comparable to beginning professional firefighters. Having more well trained first responders in our community will provide a broader measure of safety to the population in times of emergency. Furthermore, a well trained volunteer force will provide a quality pool of applicants from which to pick when the time comes to add additional professionals to our force. By training and utilizing volunteers now, the professional department would have in-depth personal knowledge of a person’s character and fitness to serve as a member of our truly honorable and professional force.

The use of a volunteer force will help alleviate some of the burden on our professionals and allow them to reduce the amount of overtime currently required. In addition, creating a volunteer force would provide adequate staffing and help reduce response times to emergency calls. Not only will this help save lives but it may increase Ventura’s ISO rating (a figure used to determine the cost of homeowner’s insurance). This could help lower the cost of homeowner’s insurance citywide. A supplemental volunteer force is the right answer for Ventura.

Editors’ Comments:

We all need to consider viable alternatives to what we have been doing in the past. Ventura’s police department has its Volunteers in Policing program. It is time we gave a much needed hand to our fire department and help them to do what they do best: serve the public interest through ensuring public safety.

Editors:

B. Alviani K. Corse T. Cook

J. Tingstrom R. McCord S. Doll

[1] 3% at age 55 means 3% of a policeman’s or firefighter’s highest annual salary times the number years of employment. For example, a 20year old works 35 years and in his last year his salary is raised to $80,000. He will be paid $84,000 a year for the rest of his life.

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.