“We don’t have a revenue problem, we have a spending problem.” — Ronald Reagan

The Scenario

The Ventura City Council is determined to raise taxes again by putting a measure on the ballot in November to increase sales taxes by 0.5%-1%. Two previous attempts failed. As is customary, they are not completely forthcoming or transparent when they are trying to extract more money from the citizenry. On January 30, 2016, the City Council held a special meeting at the Ventura Police Department whose true purpose was to discuss raising the sales tax. The Council spent $118,000 to hire consultants to sell the voters on a tax increase. What they learned should have disappointed the Council.

This City Council is pushing hard for a sales tax incease.

Council hired consultants to direct them on how to sell the voters on a tax increase

[Only 36% say Yes]

At the January 30th meeting, one paid consultant provided his interpretation of the results of a general poll on citizen’s views asked of 630 citizens. The opinions were favorable in such areas as police, fire, beaches, water, paving streets, serving veterans, and protecting the environment.

When it came to answering two questions specifically focused on the need for a sales tax increase, however, the results were remarkably different.

Question: Does the City need additional funds for City Services?

Great need = 22%

Some need = 38%

Little/no need = 30%

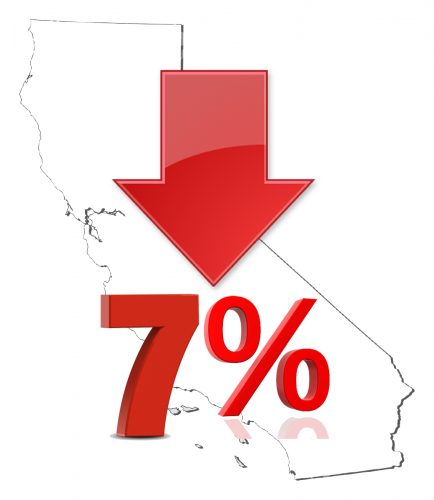

Question: If on an initial ballot you were asked to increase sales taxes by one-percent or one-half percent how would you vote?

One-percent one-half percent

Definitely yes = 36% Definitely yes = 33%

Probably yes – 12% Probably yes = 22%

No/probable no = 39% No/probable no = 31%

Interpreting the results, fewer than one in four citizens sees a great need for additional funds and only 36% would vote definitely yes for a 1% sales tax increase.

If 630 citizens surveyed believe the City is doing a favorable job with the funds they have and only 22% believe there’s a great need for additional funds, one might conclude the citizens are content with the current situation. But, the City Council—strongly encouraged by the consultants—continued to push the sales tax increase forward.

The inference is that voters are not smart and need to be led around

Ventura spends $118,000 on consultants to “sell” voters on sales tax increase

The pollster then advised the Council that they needed to do more to “educate” the people on why they should vote for a sales tax increase to receive approval. Without education it was a close call. His words were – “on the one-percent measure you might have a shot.” One council member commented that the “citizens just don’t understand.”

Next, the paid political consultant outlined that of the 109,000 Ventura residents only 24,000 vote and, of that number, 61% are over the age of 50. It was his view that an intense program was needed to “educate” voters because “they need to know what the city council is going to use the money for.”

In fact, that’s the crux of the issue. If the additional sales tax revenue goes into the General Fund, nobody will know for sure how the City Council will use the money.

MONEY FOR EVERYONE AND EVERYTHING

[The Ventura Essential Services Tax Measure]

At the conclusion of the presentation, Mayor Nasarenko announced, “I have made a sales tax measure a core goal for my year as the Mayor. I have been joined by the Deputy Mayor [Neal Andrews].”

The discussion then moved to a staff report that listed “all of the needs.” The list of needs total $1.368 billion. That is billion with a “B.” Excluding costs for Water and Wastewater totaling $661,120,000, which the citizens will pay through a 34% increase in water bills the City Council approved in 2015, which leaves $707,734,532 in needs for the General Fund.

Here are some examples of what’s on the City of Ventura government’s shopping list. It is obvious the city council wants to overwhelm the voters with the sizable need for more taxes.

| Community Enhancement |

$199,360,000 |

| Technology |

$7,420,000 |

| Streets |

$298,999,747 |

| Public Art |

$557,462 |

| Parks |

$112,192,823 |

| Facilities |

$42,087,500 |

| Fire |

$3,400,000 |

| Police |

$4,853,000 |

This wish list illustrates the consultants’ concern about Ventura citizens, “they need to know what the city council is going to use the money for.” But, here’s the rub.

As a General Fund Tax Measure, it is impossible to promise or earmark the new tax revenue to any specific project. To earmark funds requires a two-thirds majority vote (67%) on the ballot. To vote in a General Fund Tax Measure requires a simple majority (>50%).

Given the low interest in approving a sales tax increase cited in the survey (36%, at best), reaching a two-thirds majority will be a struggle. A simple majority seems more likely, if the sales tax increase is to pass at all.

Once in the General Fund, the City Council can spend the sales tax revenue as they choose.

No oversight committee, appointed by the city, has ever challenged spending after it has been spent

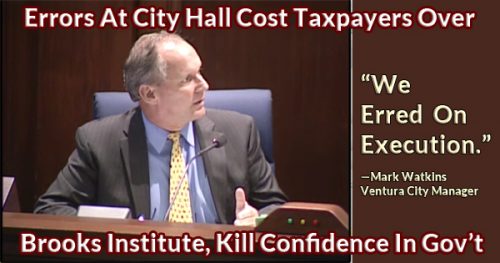

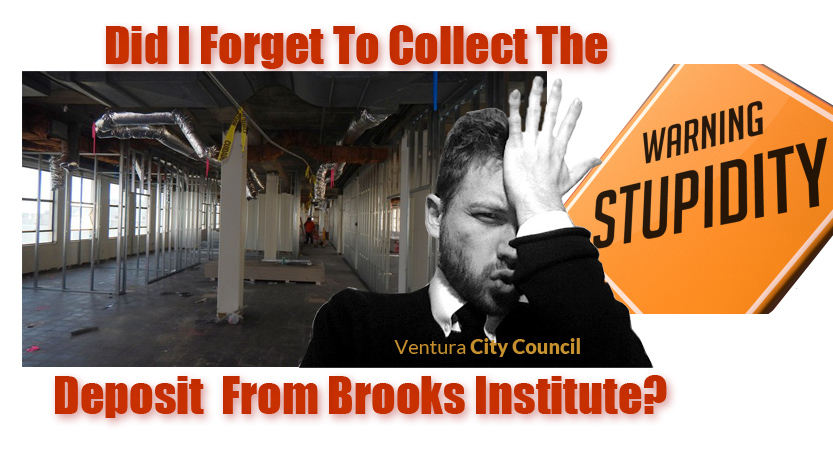

Mayor Nasarenko isn’t telling voters that no guarantee exists for the City to spend the additional tax revenue on any of the City needs once the tax receipts go into the General Fund. This Council may intend to use the funds for the projects outlined above, but Councilmembers change, city priorities change and needs change with time. In 2007-08 the signs of an economic downturn were clear yet the City government forged ahead, spending money on experts and projects as if they were immune from economic reality. Who’s to say the City won’t syphon off money intended for street repair to pay for another WAV building, for instance?

Consultants suggest a citizen’s oversight committee

So, the mayor is creating a smoke screen in his “let’s increase taxes” pitch by promising a Citizen’s Oversight Committee intended to give voters the false sense that “how funds are spent” will be closely monitored.

To monitor the funds that closely, however, a Citizen’s Oversight Committee would have to approve any project expenditure before the City makes it—effectively neutering the Council. It’s unlikely the City Council would approve that. And, even if they did, why would we need a City Council at all if this committee controlled the purse strings?

The truth is no post audit Citizen’s Oversight Committee will track city spending that closely, let alone have the power to reverse any spending after the fact. Once the Sales Tax Increase passes, the fact is nobody will look at it again and nobody will reverse any expenditure.

If you believe a sales tax increase will be spent unwisely, raise your voice. Write to the City Council to share your opinion. In addition, insist Council Members Heitmann, Morehouse and Weir—all up for re-election in the November 2016—thoroughly explain their position on the sales tax increase. After all, they have a balanced budget, they increased water rates by 34% and they have revenues up $20 million to pre-2008 levels.

Click On The Councilmember’s Photo Below To Send An Email

Erik Nasarenko,

Mayor |

|

Neal Andrews,

Deputy Mayor |

Cheryl Heitmann |

|

Jim Monahan |

Carl Morehouse |

|

Mike Tracy |

Christy Weir |

|

|

Editors:

R. Alviani, K. Corse, T. Cook, R. Berry,

J. Tingstrom, R. McCord, S. Doll, C. Kistner,

W. Frank

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Our new logo captures what Venturans for Responsible and Efficient Government is about. We explain how Ventura city government manages our finances. Our goal is to examine the policy decisions behind our tax dollar expenditures. The new logo features a hand signaling to stop the wasteful use of our money. We’re your eyes and ears to guarantee our elected officials spend on projects for the city’s good.

Our new logo captures what Venturans for Responsible and Efficient Government is about. We explain how Ventura city government manages our finances. Our goal is to examine the policy decisions behind our tax dollar expenditures. The new logo features a hand signaling to stop the wasteful use of our money. We’re your eyes and ears to guarantee our elected officials spend on projects for the city’s good.