The Real Story Behind Ventura’s Proposed Sales Tax Increase

“We don’t have a revenue problem, we have a spending problem.”

—Ronald Reagan

THE CAMEL IS TRYING TO GET ITS NOSE INTO THE TENT

Ventura City Council is looking for a permanent sales tax increase of 0.5%-1%. It is a forever tax, despite any protestations to the contrary. Can this Council be trusted to spend the new money wisely to benefit the community, or will they waste it? Until this City Council answers this question voters should not pass the measure.

MISREPRESENTING A CITIZENS’ INVOLVEMENT MEETING

On January 30, 2016, the City Council held a special meeting at the Ventura Police Department. The announced purpose of the meeting, in the advanced notice required by the Brown Act was to conduct a working session to set the goals for the City Council for 2016. Instead, the true purpose of the meeting was to discuss raising the sales tax.

WITH INCREASES IN SALES AND PROPERTY TAXES, THE CITY HAS RECOVERED FROM 2007

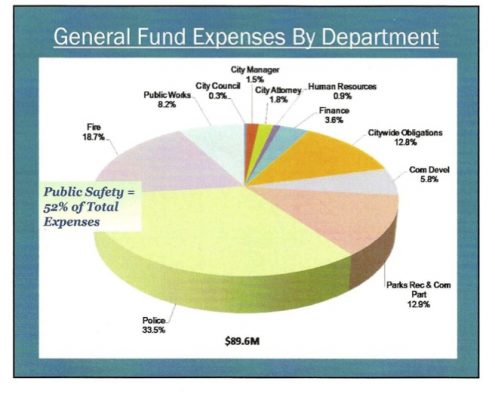

Those attending heard Ventura Chief Financial Officer, Gil Garcia, outline the current financial posture of the City. Garcia stated that the income of the City had recovered back to the level that existed prior to the 2008 recession. In 2007, revenue totaled $93,926,316, but that dropped $20 million to $73,684,565 as the bottom fell out of the economy.

Increasing City income by $20 million dollars in a 4-year period is a positive step forward. This 27% overall increase is comprised of a 4% increase in real property taxes and increase of 9.5% in sales tax revenue.

IF REVENUES ARE UP BY 27%, WHY TAX THE CITIZENS MORE?

At the conclusion of the presentation new Mayor Erik Nassarenko announced, ” I have made a sales tax measure a core goal for my year as the Mayor. I have been joined by the Deputy Mayor [Neal Andrews]”. Erik and the City Council are seeking a 0.5%-1% increase in the sales tax that would generate an additional $10.9 million dollars to $21.7 million respectively.

The mayor justifies the new tax increase because:

- Ventura is 150 years old with a stunning “natural landscape that is costly to maintain”

- “Ventura is an old city, our sewer systems, our water systems, our roads and sidewalks, and our buildings need costly attention”

- “Like our historic pier, the City of Ventura has unique features that require maintenance, care and funding”

- “Our fire stations must remain open to provide life saving paramedic response

- We must protect our waterways from pollution”. (Source: The Breeze)

EVERY DOLLAR OF GOVERNMENT WASTE COMES DIRECTLY FROM YOUR POCKET

What was not discussed was the extent of the spending waste since 2007.

- $2.5 million lost in funding the market condos and stores in the WAV projects.

- $1 million spent in studying the narrowing of Victoria.

- $5 million lost to the internal service funds because of general fund manipulation by the then City Manager Rick Cole.

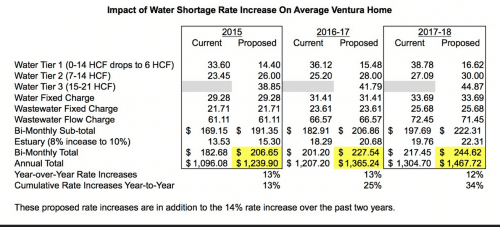

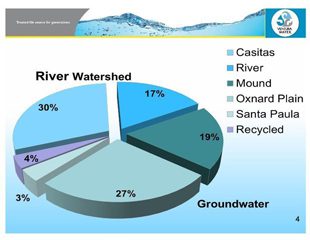

- Citizens are already paying for improvements to our water and sewer system through a 34% increase in water bills.

NO ONE WANTS IT

No one wants a sales tax increase. Outside experts hired by the City Council told them only 33-36% of the persons polled would vote in favor of a tax increase. [64%-67% of the respondents were against or ambivalent to the tax increase] Furthermore, they told the Council to achieve a majority the Council needs to wage an election person-to-person “education campaign” so that the people would understand why this money was needed.

Propaganda Campaign To “Educate” Voters

IT’S NOT A REVENUE PROBLEM

President Reagan said, “We don’t have a revenue problem, we have a spending problem.” The answer isn’t always to tax our people more, but to spend their money more wisely. If you believe a sales tax increase will be spent unwisely, make your voice heard. Write to the City Council to share your opinion. In addition, insist all the candidates in the November 2016 election thoroughly explain his/her position on the sales tax increase. Have him/her justify why we need a sales tax at all.

There will be two more parts of this newsletter to follow in the next few weeks.

Editors:

R. Alviani, K. Corse, T. Cook, R. Berry,

J. Tingstrom, R. McCord, S. Doll, C. Kistner,

W. Frank

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Fool me once, shame on you. Fool me twice, shame on me.

Fool me once, shame on you. Fool me twice, shame on me.