Unaddressed Issues That Threaten Ventura’s Quality Of Life

Three unaddressed issues will be difficult to overcome.

VREG’s STATE OF THE CITY

[THE UNADDRESSED ISSUES MAYOR NASARENKO NEGLECTED TO DISCUSS]

No doubt that Ventura is a magnificent place to call home. On many aspects, VREG agrees on more points with our Mayor and City Council, than disagree. Ventura’s citizens are proud of our fine police force and our fire department. Our city employees are a dedicated group of men and women, who work hard and serve the community well.

THREE UNADDRESSED ISSUES

Some issues Mayor Nasarenko highlighted in his State-of-the-City speech are ones VREG has written about for years. Ventura has several issues that need attention before they grow out of control.

Mayor Nasarenko identified water and pensions among those issues in the State-of-the-City. The impending Brooks Institute lawsuit was conveniently overlooked. The mayor was short on details on how to solve them.

WATER: UNADDRESSED ISSUE #1

Water has been an unaddressed issue for over 37 years.

For 150 years, Ventura has failed to find an alternative source for water. In fact, with the loss of the Ventura River water wells, there are fewer resources. In 1972, Ventura opted to import 10,000 acre feet of water from the north. Ventura has paid and continues to pay for that every year without any pipeline with which to receive it. In 1989, the community faced a drought, and 52% elected to pursue desalinization. 48% chose to build a pipeline as an alternative. For the last 26 years, nothing has happened.

Now, with another 7-year drought which may be ending, a recent editorial in the Ventura County Star on the water crisis states:

“The department’s poor handling of Ventura’s water has created an avoidable “perfect storm.

“The loss of Lake Casitas water will force it to adapt cross-town pipelines and start pumping east-side water to the west side to meet demand. Continued implementation of the horribly timed housing boom on the east side will further exacerbate water shortages and leave residents with high-priced/low-quality water and not enough of it.

“Meanwhile, the city is frantically trying to dig replacement wells rather than moving ahead with new ones, and consumers’ water bills will go even higher to offset that cost.”

In January, the Ventura City Council authorized a $430,976 study (or as low as $297,176 depending upon the results of the engineering study) to research the cost to connect to the State Water Project. The State Water Project that has existed for 46 years. Yet, Ventura cannot use it without extra infrastructure.

CITY COUNCIL NOT CONSIDERING ALL AVAILABLE OPTIONS

Our Mayor has also shared that Ventura is looking at potential sites for a water reuse plant. Dubbed the Ventura Water Pure, the plant is an advanced treatment facility. It will take 8 years to build the treatment facility. Projected costs range between $120 million and $142 million.

Water from this treatment facility could cost less than state water and would be more reliable. It is also about half the cost of energy-intensive desalinated water. From the start, such a plant could yield about one fourth of the city’s current annual water demand. According to our Mayor, the plant could later expand to meet future supply needs of Ventura.

One advantage of connecting to the State Water Project is that it will not take 8 years like the Ventura Water Pure plant will require.

Is there another water rate increase in the offering?

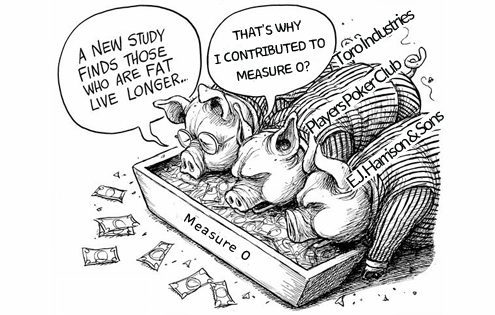

PENSIONS: UNADDRESSED ISSUE #2

Pensions are an unaddressed issue Ventura struggles with.

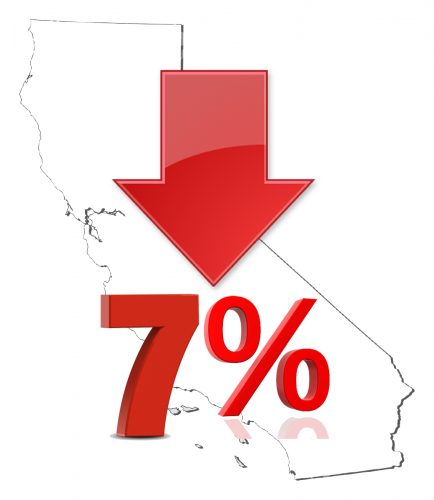

CalPERS annual billing for pensions is rising faster than employee contributions. As a result, the city continues to lose ground on employee pensions. The city’s annual cost of $16 million is projected to be $25 million by 2023. Ventura’s CalPERS payments are rising at over $1 million per year. Because CalPERS lowered its rate of return to 7% from 7.5%, add another $750,000 to the $1 million annually.

While our Mayor acknowledges the problem, he offers no solutions.

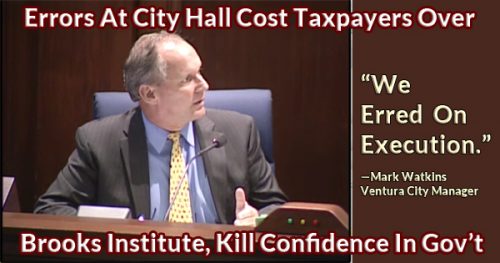

BROOKS INSTITUTE LAWSUIT: UNADDRESSED ISSUE #3

In August 2016, VREG concluded a lawsuit over Brooks Institute was inevitable. The lawsuit will come at taxpayer expense. The City Council and the City Manager downplayed the possibility at the time. This may have been an attempt to deflect the seriousness of the problem.

Fast forward to Feb. 8, 2017, one week before the Mayor’s State of the City. Ventura is now suing Brooks.

Editors’ Comments:

City government tries its best to serve our citizens. Like any community, there are also areas that either need improvement or simply require attention before big troubles get out of control. This is a collective reminder that we, as a community, through our elected officials, still have work to do in vital areas in order to sustain our way of life.

THINK VENTURA SHOULD TACKLE AT LEAST ONE UNADDRESSED ISSUE?

[WRITE YOUR COUNCILMEMBER]

Click on the photo of a Councilmember to send him or her a direct email.

Editors:

R. Alviani K. Corse T. Cook B. Frank

J. Tingstrom R. McCord S. Doll C. Kistner

For more information like this, subscribe to our newsletter, Res Publica. Click here to enter your name and email address.

Our new logo captures what Venturans for Responsible and Efficient Government is about. We explain how Ventura city government manages our finances. Our goal is to examine the policy decisions behind our tax dollar expenditures. The new logo features a hand signaling to stop the wasteful use of our money. We’re your eyes and ears to guarantee our elected officials spend on projects for the city’s good.

Our new logo captures what Venturans for Responsible and Efficient Government is about. We explain how Ventura city government manages our finances. Our goal is to examine the policy decisions behind our tax dollar expenditures. The new logo features a hand signaling to stop the wasteful use of our money. We’re your eyes and ears to guarantee our elected officials spend on projects for the city’s good.